Table of Contents - Hot Tub Financing: The Complete 2026 Guide to Funding Your Dream Spa

- Why Financing a Hot Tub is More Common Than You Think

- What is Hot Tub Financing?

- The True Cost of a Hot Tub: Beyond the Sticker Price

- Unsecured Personal Loans: The Most Flexible Option

- In-House Dealer Financing: Convenience at a Cost

- Home Equity Financing: Using Your House as Collateral

- Other Financing Methods to Consider

- Step 1: Check and Understand Your Credit Score

- Step 2: Determine Your Total Budget

- Step 3: Get Pre-Qualified with Multiple Lenders

- Step 4: Compare Your Loan Offers

- Step 5: Finalize Your Application and Secure Funding

- How to Get Hot Tub Financing with Bad Credit

- The Hot Tub Payment Calculator: Estimating Your Monthly Cost

- Is Financing a Hot Tub a Good Investment?

- Key Takeaways for Financing Your Hot Tub

- Your Next Steps

- Your Hot Tub Financing Questions Answered

- What credit score do I need to finance a hot tub?

- Can you make monthly payments on a hot tub?

- Is 0% financing for a hot tub a good deal?

- How much is a typical monthly payment for a hot tub?

- Is it hard to get financing for a hot tub?

- Can I finance the hot tub installation and electrical work too?

- Is it better to use a personal loan or dealer financing?

- How much of a down payment do I need for a hot tub?

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Owning a hot tub has evolved from a luxury status symbol into a genuine wellness investment that millions of American families now consider accessible and practical. Smart financing options have opened the door for homeowners who want the therapeutic benefits of hydrotherapy without depleting their savings accounts. This comprehensive guide will walk you through every financing avenue available in 2026, helping you understand the true costs involved, navigate credit requirements, compare loan types, and ultimately make an informed decision that fits your budget and lifestyle.

Why Financing a Hot Tub is More Common Than You Think

The hot tub industry has matured significantly over the past decade, and with that maturation has come a sophisticated ecosystem of financing solutions designed specifically for this type of home improvement purchase. According to industry data, approximately 60-70% of hot tub buyers now use some form of financing rather than paying cash upfront. This shift reflects both the increasing costs of quality hot tubs and the recognition that preserving liquidity while enjoying immediate wellness benefits makes financial sense for many households.

Modern hot tub financing mirrors the car buying experience. Just as most people finance their vehicles, homeowners are discovering that spreading out payments over time makes owning a premium hot tub realistic even on moderate budgets. The key difference lies in understanding which financing option aligns best with your specific financial situation, credit profile, and long-term goals.

The democratization of hot tub ownership through accessible financing has also coincided with growing awareness of the health benefits associated with regular hydrotherapy. From chronic pain management to stress reduction and improved sleep quality, the return on investment extends far beyond simple recreation when viewed through a wellness lens.

What is Hot Tub Financing?

Hot tub financing is a structured payment arrangement that allows you to purchase a hot tub and pay for it over time through predictable monthly installments rather than a single lump sum. The concept works identically to an auto loan or personal loan. You borrow a specific amount from a lender, use those funds to purchase the hot tub, and then repay the lender with interest over an agreed-upon term, typically ranging from 24 to 84 months.

An important distinction exists between financing just the hot tub unit versus financing the entire project. The hot tub itself might cost anywhere from $3,000 to $15,000 or more, but the complete installation often includes additional expenses like electrical work, foundation preparation, delivery, and accessories. Some financing options only cover the spa unit itself, while others provide the flexibility to fund the comprehensive project cost.

Understanding this distinction upfront helps you avoid the common pitfall of securing financing for the hot tub purchase only to discover you lack funds for the required electrical upgrades or concrete pad installation. The most effective financing strategy accounts for every dollar needed to get your hot tub operational and enjoyable.

The True Cost of a Hot Tub: Beyond the Sticker Price

Accurately calculating your total financing needs requires looking beyond the advertised price tag. Many first-time buyers underestimate the complete investment required to go from purchase to that first relaxing soak. This comprehensive breakdown ensures your financing covers everything necessary while avoiding unwelcome surprises midway through your project.

The Hot Tub Unit Itself

Entry-level inflatable or plug-and-play models start around $500 to $3,000, though these typically lack the durability and features of acrylic models. Mid-range acrylic hot tubs with quality components, seating for four to six people, and standard features generally range from $5,000 to $10,000. Premium luxury models with advanced jet systems, superior insulation, LED lighting, waterfalls, and therapeutic seating configurations can easily reach $12,000 to $20,000 or more.

Swim spas, which combine exercise capability with hot tub relaxation, represent the upper tier of the market, typically starting around $15,000 and extending beyond $40,000 for top-tier models. When planning your financing, consider not just your immediate budget but also the long-term value proposition, as higher-quality units often provide better energy efficiency and require fewer repairs over their lifespan.Tub

If you’re still researching which hot tub size fits your space and needs, understandinghow much does a hot tub cost across different categories will help you establish a realistic budget before approaching lenders.

Essential Installation Costs

Installation expenses often catch buyers off guard, sometimes adding 20-40% to the total project cost. Incorporating these figures into your financing request from the outset prevents cash flow problems during the installation phase.

Electrical Work and Requirements

Most quality hot tubs require a dedicated 220V to 240V GFCI-protected circuit installed by a licensed electrician. This specialized electrical work typically costs between $500 and $2,500, depending on the distance from your electrical panel to the hot tub location, whether trenching is required for underground conduit, local permit fees, and your region’s prevailing labor rates.

Never attempt to cut corners on electrical requirements. Proper installation ensures safe operation and prevents both fire hazards and damage to your hot tub’s components. Some municipalities require inspections, which add to the timeline and cost but provide essential safety verification.

Foundation and Site Preparation

Your hot tub needs a stable, level foundation capable of supporting tremendous weight. A filled hot tub with occupants can easily exceed 4,000 to 6,000 pounds. Foundation options include poured concrete pads, which typically cost $500 to $2,000 depending on size, professionally installed paver patios ranging from $800 to $3,000, or a reinforced deck with proper joists and support, which varies widely based on complexity.

The specifichot tub dimensions you choose will directly impact foundation requirements, as larger models demand more substantial support structures. Site preparation may also include grading, drainage solutions, or removing existing landscaping, each adding to your total project budget.

Delivery and Placement Fees

Many dealers include basic delivery within a certain radius, but “basic” often means curbside or driveway delivery only. Professional placement to your backyard, navigating tight spaces, or lifting over fences typically incurs additional charges ranging from $200 to $800. Exceptionally challenging installations requiring a crane can add $1,000 to $3,000 to your total cost.

Confirming exactly what your dealer’s delivery service includes and what triggers additional fees helps you budget accurately. Geographic factors matter significantly, with rural locations or difficult access sites commanding premium delivery charges.

Ongoing Ownership Costs to Consider

While financing doesn’t typically cover ongoing operational expenses, understanding these costs helps you evaluate the total financial commitment. Monthly electricity costs range from $20 to $50 for well-insulated modern models but can exceed $100 for older or poorly insulated units in cold climates.

Chemical treatments, test strips, and water care products generally run $20 to $40 monthly. Filter replacements every 12 to 24 months cost $50 to $150 per set. Setting aside $30 to $75 monthly for these recurring expenses ensures hot tub ownership remains financially sustainable beyond the financed purchase.

Unsecured Personal Loans: The Most Flexible Option

Personal loans have emerged as one of the most popular and versatile financing vehicles for hot tub purchases, offering distinct advantages that appeal to buyers who value flexibility and straightforward terms.

What is an Unsecured Personal Loan?

An unsecured personal loan is borrowed money from a bank, credit union, or online lending platform that doesn’t require collateral. Unlike a mortgage or auto loan where the house or car secures the debt, personal loans are issued based primarily on your creditworthiness, income, and debt-to-income ratio.

The lender evaluates your financial profile and extends credit with the expectation that your good credit history and stable income indicate you’ll honor the repayment obligation. If you default, the lender cannot immediately seize an asset but can damage your credit and potentially pursue legal collection action.

Pros of Using a Personal Loan for a Hot Tub

Personal loans offer several compelling advantages for hot tub financing. Rapid funding stands out as a primary benefit, with many online lenders providing approval decisions within minutes and funds deposited in your account within 24 to 72 hours. This speed allows you to act quickly on limited-time dealer promotions or seasonal sales.

Fixed interest rates provide predictability. Unlike credit cards or HELOCs with variable rates, personal loans lock in your rate at origination, ensuring your monthly payment never fluctuates over the loan term. This stability simplifies budgeting and protects you from interest rate increases.

Immediate ownership represents another significant advantage. The moment you purchase the hot tub with personal loan funds, you own it outright with no lien held by the dealer. This ownership freedom matters if you decide to move, want to sell the hot tub, or need to make modifications.

Perhaps most importantly, personal loans provide cash you control, meaning you can finance the comprehensive project cost including the hot tub, electrical installation, foundation work, accessories, and even a contingency buffer for unexpected expenses. This contrasts sharply with dealer financing that typically covers only the spa unit itself.

Cons and What to Watch For

Interest rates on personal loans vary considerably based on your credit profile. Borrowers with excellent credit scores above 760 might secure rates between 6% and 10%, while those with fair credit in the 650 to 699 range often face rates between 12% and 18%. Lower credit scores can push rates even higher, sometimes exceeding 25% with certain lenders.

Some lenders charge origination fees ranging from 1% to 8% of the loan amount, effectively increasing your borrowing cost. A 5% origination fee on a $10,000 loan means you receive only $9,500 but must repay the full $10,000 plus interest. Always calculate the APR, which includes these fees, rather than focusing solely on the stated interest rate.

Personal loans also typically involve shorter maximum terms than home equity products, usually capping at 60 to 84 months. While this limits how low you can push monthly payments, it also means you pay less total interest and eliminate the debt faster.

Where to Find Hot Tub Personal Loans

Online lenders like LightStream, SoFi, Marcus by Goldman Sachs, and Upstart have become major players in the personal loan market. These platforms often offer competitive rates, streamlined applications, and quick funding. Their automated underwriting systems can sometimes approve borrowers that traditional banks might decline.

Traditional banks where you already hold accounts may offer relationship discounts or more flexible qualification criteria for existing customers. If your bank knows your financial history, they might extend more favorable terms than you’d receive as a new applicant elsewhere.

Credit unions deserve special attention as they’re member-owned institutions that often provide the most competitive personal loan rates available. If you’re eligible to join a credit union through your employer, geographic location, or family connection, their personal loan offerings frequently beat both banks and online lenders by one to three percentage points.

In-House Dealer Financing: Convenience at a Cost

Hot tub dealers frequently advertise attractive financing options available right at the point of sale, creating a seamless purchasing experience that appeals to buyers who value convenience and immediate answers.

How Dealer Financing Works

Dealer financing isn’t actually provided by the hot tub retailer itself. Instead, dealers partner with financial institutions like Wells Fargo, Synchrony Financial,TD Bank, or specialized lenders that fund recreational purchases. When you apply for dealer financing, you’re essentially applying to the dealer’s lending partner, with the dealer acting as an intermediary.

The application process typically happens in-store, often with instant or same-day approval decisions. Once approved, the financing terms are built directly into your purchase agreement, and you leave the dealership with both your new hot tub and a payment plan in place. The simplicity appeals to buyers who want a one-stop shopping experience without coordinating separate loan applications.

The Allure of 0% APR and Special Promotions

Walk into almost any hot tub showroom and you’ll encounter promotional financing offers: “0% APR for 24 months” or “No interest if paid in full within 18 months.” These promotions sound incredibly attractive and can indeed provide genuine value, but understanding the fine print is absolutely critical.

Most zero-percent offers operate on a deferred interest model rather than true no-interest financing. Here’s how it works: you make minimum monthly payments during the promotional period at 0% interest, but if you fail to pay the entire balance before the promotion expires, the lender retroactively applies interest to the original purchase amount from day one, typically at rates between 18% and 29.99%.

Consider this example: You finance a $10,000 hot tub with “0% APR for 24 months” that carries a 24.99% deferred interest rate. You make minimum payments totaling $8,500 over 23 months but still owe $1,500 when the promotional period ends. The lender then calculates 24.99% interest on the full $10,000 over those 24 months, adding approximately $5,000 to your remaining balance. You suddenly owe around $6,500 despite having already paid $8,500.

These offers work beautifully for disciplined borrowers who can and will pay the balance in full before expiration. Setting up automatic payments that fully amortize the balance over the promotional period turns these deals into genuinely free financing. But missing the deadline or making only minimum payments transforms an attractive offer into an expensive trap.

Pros of Dealer Financing

Convenience stands as the primary advantage. You handle everything in one location with one application process, eliminating the need to coordinate loan approvals before shopping or arrange payment after selecting your hot tub. For buyers who value simplicity and immediacy, this streamlined approach holds considerable appeal.

Instant approval decisions mean you walk out knowing whether you’re approved and at what terms, allowing you to make purchase decisions immediately. This certainty helps when dealers offer limited-time pricing or when you’re choosing between multiple models with different price points.

Frequent promotional offers provide opportunities for genuinely valuable financing if you can meet the payoff requirements. Some dealers also offer flexibility for buyers with imperfect credit through partnerships with multiple lenders at different credit tiers.

Cons of Dealer Financing

Coverage limitations represent a significant drawback. Most dealer financing applies only to the hot tub purchase itself, excluding installation costs, electrical work, or foundation preparation. This restriction means you’ll need alternative funding sources for the additional 20-40% of project costs, potentially complicating your financing picture.

Limited negotiating power can cost you money. When you finance through the dealer, you lose the leverage that comes with being a cash buyer. Dealers may be less willing to discount the purchase price when they’re earning referral fees or other compensation from the financing arrangement. Securing your own financing and approaching the dealer as a cash buyer often yields better negotiating outcomes on the spa’s purchase price.

Partner limitations mean you’re restricted to the dealer’s specific lending relationships rather than shopping the broader market. If the dealer partners with just one or two lenders, you might miss better rates available through your credit union or a competitive online lender.

The promotional period pressure creates stress and risk. That attractive zero-percent offer becomes a ticking clock that, if you miscalculate your ability to pay in full, transforms into one of the most expensive financing options available.

Home Equity Financing: Using Your House as Collateral

Homeowners with substantial equity can access some of the lowest interest rates available by borrowing against their home’s value, though this approach introduces risks that demand careful consideration.

Home Equity Loans vs. HELOCs

A home equity loan, sometimes called a second mortgage, provides a lump-sum payment with a fixed interest rate and fixed monthly payments over a set term, typically 10 to 30 years. You receive all the funds at once, know exactly what you’ll pay monthly, and have a clear payoff timeline. This structure works well for one-time purchases like a hot tub when you know the exact amount needed.

A Home Equity Line of Credit, or HELOC, functions more like a credit card secured by your home. The lender approves a maximum credit line based on your available equity, and you can draw funds as needed up to that limit during a draw period, typically 5 to 10 years. Interest rates are usually variable, adjusting with market conditions, and you pay interest only on the amount actually borrowed. After the draw period, you enter a repayment period where you can no longer borrow and must pay down the balance.

HELOCs offer flexibility if you have multiple home projects planned or uncertain costs, while home equity loans provide the predictability of fixed payments and rates. For a hot tub purchase with a known total cost, the home equity loan typically makes more sense.

Pros of Home Equity Financing

Interest rates represent the compelling advantage of home equity products. Because your house secures the loan, lenders accept less risk and reward you with significantly lower rates. While personal loans might charge 8% to 18%, home equity loans often range from 6% to 10%, and sometimes lower for borrowers with excellent credit and substantial equity.

Potential tax deductibility offers another benefit, though tax laws have tightened considerably. Under current IRS rules, home equity loan interest is deductible only if you use the funds to “buy, build, or substantially improve” the home that secures the loan. A hot tub permanently installed and attached to your property might qualify, especially if installed as part of a broader deck or patio project, but this represents a gray area. Always consult a qualified tax professional rather than assuming deductibility, as individual circumstances vary and tax laws change.

Longer repayment terms allow you to minimize monthly payments. A 20-year home equity loan spreads payments over 240 months compared to perhaps 60 months for a personal loan, dramatically reducing the monthly obligation. This extended timeline can make a hot tub affordable even on modest monthly budgets.

Cons and Major Risks

Your home serves as collateral, meaning defaulting on the loan can ultimately result in foreclosure. This risk fundamentally changes the equation compared to unsecured financing. With a personal loan, default damages your credit severely and may lead to collections or lawsuits, but your house isn’t immediately at risk. With home equity financing, you’re literally betting your home that you’ll maintain the ability to make payments for potentially decades.

The application process mirrors getting a mortgage, complete with appraisals, title searches, extensive documentation, and processing timelines measured in weeks rather than days. If you need funds quickly to capture a limited-time dealer promotion, home equity financing likely won’t move fast enough.

Closing costs can range from 2% to 5% of the loan amount, potentially adding $500 to $2,000 or more in upfront expenses. These costs include appraisal fees, title insurance, origination fees, and various administrative charges. For smaller loan amounts, these closing costs can make home equity financing economically inefficient compared to a personal loan with a modest origination fee.

The temptation to overborrow presents a subtle but dangerous risk. When a lender approves you for a $50,000 HELOC but you only need $12,000 for your hot tub project, the psychological temptation to fund other purchases or tackle additional projects can lead to excessive debt accumulation. Discipline becomes essential to borrow only what you genuinely need.

Other Financing Methods to Consider

Beyond the three primary financing avenues, several alternative approaches deserve mention, though each carries specific limitations or risks that make them suitable only for particular situations.

Using a Credit Card

Financing a hot tub purchase with a credit card represents a high-risk strategy that makes sense only under very specific circumstances. Standard credit card interest rates typically range from 16% to 29%, making this among the most expensive financing options if you carry a balance. The math rarely works in your favor when you’re paying 24%APR on a depreciating asset.

However, the equation changes dramatically if you qualify for a premium rewards card offering a 0% introductory APR period on purchases, typically lasting 12 to 21 months. If you secure a card with an 18-month 0% intro period and a credit limit covering your hot tub’s full cost, you can finance the purchase interest-free provided you pay the entire balance before the promotional period expires.

This strategy requires iron discipline and mathematical certainty. Calculate the monthly payment needed to completely eliminate the balance before interest kicks in, typically at a punitive rate above 20%. Set up automatic payments for at least that amount, and treat missing the deadline as financially catastrophic because it is. One missed calculation or unexpected life event that prevents full payoff transforms this strategy from clever to disastrous.

The rewards angle offers a minor additional benefit. Many premium cards provide 2% to 5% cash back or valuable points on purchases. Charging a $10,000 hot tub to a 2% cash back card nets you $200 in rewards, essentially a small discount on your purchase. But this minor benefit never justifies carrying a balance at standard credit card rates.

Refinancing Your Mortgage Cash-Out Refi

A cash-out refinance replaces your existing mortgage with a larger loan, providing the difference in cash that you can use for any purpose, including hot tub purchases. This approach makes sense only when mortgage rates are favorable relative to your existing rate and when you’re already considering refinancing for other reasons.

The pros include accessing the absolute lowest interest rates available, often in the 6% to 8% range depending on market conditions and your credit profile. These rates beat virtually every other financing option. You also consolidate everything into a single monthly payment rather than managing multiple obligations.

The cons are substantial and often disqualifying. Closing costs on a mortgage refinance typically run 2% to 6% of the loan amount. On a $300,000 refinance, you might pay $6,000 to $18,000 in closing costs just to access funds for a hot tub, making theeconomics absurd unless you’re refinancing anyway to lower your rate or eliminate PMI.

Resetting your mortgage clock carries long-term costs. If you’re 10 years into a 30-year mortgage and refinance into a new 30-year loan, you’ve just added 10 years of payments to your timeline. Even at a lower rate, the extended term often means paying substantially more interest over the life of the loan.

This option makes sense only when interest rate conditions favor refinancing regardless of the hot tub purchase, and when you’d tap that equity anyway for multiple large expenses. Using it solely to finance a hot tub represents financial overkill that serves neither your short-term liquidity nor long-term wealth building.

Step 1: Check and Understand Your Credit Score

Your credit score functions as the single most influential factor determining which financing options you’ll access and what interest rates lenders will offer. Beginning your financing journey by understanding exactly where you stand empowers you to make realistic plans and potentially improve your position before applying.

Lenders use credit scores as a risk assessment tool, predicting the statistical likelihood that you’ll repay borrowed money as agreed. Higher scores unlock better rates because they signal lower risk, while lower scores limit your options and increase borrowing costs. The difference between good credit and excellent credit can mean thousands of dollars in interest over a loan’s life.

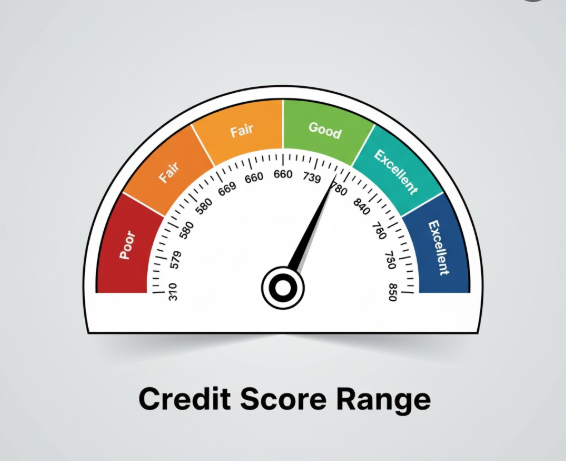

Credit scoring models, primarily FICO and VantageScore, range from 300 to 850. Here’s how lenders typically categorize scores and what each tier means for hot tub financing. Exceptional credit spans 800 to 850, qualifying you for the absolute best rates available, often several percentage points below average offers. Lenders compete aggressively for borrowers in this range.

Very good credit ranges from 740 to 799, still accessing premium rates with virtually guaranteed approval from quality lenders. You’ll receive competitive offers from banks, credit unions, and online platforms. Good credit covers 670 to 739, qualifying you for most mainstream loan products at reasonable but not premium rates. You’ll likely pay one to three percentage points above the best advertised rates.

Fair credit spans 580 to 669, where financing becomes more challenging and expensive. You’ll face higher interest rates, potentially in the 15% to 25% range, and some lenders may decline your application. Approval is possible but requires shopping specifically for lenders serving this credit tier. Poor credit registers below 580, severely limiting options and pushing rates above 25% with many lenders. Dealer financing through subprime partners or secured loan products become your most viable paths.

Accessing your credit score has never been easier. Federal law entitles you to one free credit report annually from each of the three major bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com. Many credit card issuers now provide free monthly FICO scores to cardholders. Services like Credit Karma offer free VantageScores, though note these may differ slightly from the FICO scores most lenders use.

Check your credit at least 30 to 60 days before applying for financing. This timeline provides opportunity to identify and dispute any errors on your report, which surprisingly appear on about 20% of credit reports according to FTC research. Even small improvements to your score can shift you into a better rate tier, potentially saving hundreds or thousands of dollars.

Step 2: Determine Your Total Budget

Creating a comprehensive budget prevents the common mistake of financing the hot tub purchase while lacking funds for essential installation costs. Your financing amount should cover every expense required to transform your backyard into a functional spa retreat.

Start with the hot tub unit itself, including any accessories you plan to purchase immediately such as steps, covers, cover lifters, or starter chemical kits. Add delivery and placement fees, remembering that basic delivery often differs from professional installation to your desired location. Include electrical work based on quotes from at least two licensed electricians, as this line item varies significantly based on your specific site requirements.

Calculate foundation costs whether you’re building a new concrete pad, installing pavers, or reinforcing an existing deck. If landscaping modifications are necessary, estimate those expenses. Consider adding a 10% to 15% contingency buffer for unexpected complications, permit fees, or price adjustments.

For example, a comprehensive budget might look like this: Hot tub unit at $8,500, professional delivery and placement at $400, electrical installation at $1,200, concrete pad at $1,500, steps and accessories at $300, and a 10% contingency at $1,190, totaling $13,090. Rounding up to request $13,500 in financing provides a comfortable margin while ensuring you’re not scrambling for additional funds mid-project.

This total budget figure becomes your target loan amount when comparing financing options. Knowing you need $13,500 rather than just the $8,500 sticker price fundamentally changes which financing products make sense and ensures your project doesn’t stall halfway through due to cash flow problems.

Step 3: Get Pre-Qualified with Multiple Lenders

Shopping for financing before committing to a hot tub purchase gives you negotiating leverage and ensures you understand the true affordability of different models. Pre-qualification provides estimated terms without impacting your credit score, while pre-approval involves a hard credit inquiry but offers firmer commitments.

Pre-qualification typically requires basic information like your income range, employment status, desired loan amount, and estimated credit score. The lender performs a soft credit check that doesn’t affect your score and provides estimated APR ranges and potential monthly payments. This soft inquiry appears only on your personal credit report, not to other lenders, and doesn’t count against you.

Pre-approval involves a full credit application with a hard inquiry that temporarily dings your score by a few points and appears to other lenders. In exchange, you receive a firm offer with specific terms, locked for a period typically ranging from 30 to 90 days. The hard inquiry impact is minimal, usually lowering your score by five points or less, and credit scoring models treat multiple hard inquiries for the same type of loan within a 14 to 45-day window as a single inquiry.

Seek pre-qualification from at least three sources to build a comprehensive picture of your options. Start with an online lender like LightStream or SoFi, known for competitive rates and fast approvals. Their streamlined applications often provide instant pre-qualification results. Check with your primary bank or credit union, especially if you’ve maintained accounts there for several years, as existing relationships sometimes unlock better terms.

Inquire about the dealer’s financing options if you’ve already visited showrooms and identified your preferred retailer. While you shouldn’t commit to dealer financing without comparison shopping, understanding what they offer provides a valuable benchmark. Some dealers work with multiple lending partners and can submit your application to several simultaneously, though this can generate multiple hard inquiries if not managed carefully.

Document each offer carefully, noting the APR, loan term options, monthly payment estimates, any fees, and special conditions. This organized comparison becomes the foundation for your final decision in the next step.

Step 4: Compare Your Loan Offers

Raw interest rates tell only part of the financing story. Comprehensive comparison requires examining multiple factors that collectively determine the true cost and suitability of each offer.

Key Metrics to Compare

APR, or Annual Percentage Rate, represents your most important comparison point because it includes both the interest rate and most fees, providing a truer picture of borrowing costs than the interest rate alone. A loan advertising 7.99% interest with a 5% origination fee might have an APR above 10%, potentially making it more expensive than a competitor offering 9.5% with no origination fee.

Loan term, measured in months, directly affects both your monthly payment and total interest paid. Longer terms reduce monthly obligations but increase total interest dramatically. Consider multiple term options for each lender to understand the trade-offs. A 36-month term might create uncomfortably high payments but minimize interest, while a 72-month term eases monthly budgets but potentially doubles your total interest cost.

Monthly payment amount should fit comfortably within your budget with room for the ongoing ownership costs discussed earlier. Financial advisors commonly recommend that all debt payments combined shouldn’t exceed 36% of your gross monthly income. If your hot tub payment pushes you beyond this threshold, consider a less expensive model or delay the purchase until your financial situation improves.

Total interest paid reveals the complete cost of borrowing. A $10,000 loan at 8% APR for 36 months costs about $1,280 in interest, while the same amount at 8% for 72 months costs approximately $2,480 in interest. That extra three years of payments doubles your interest cost despite the identical APR. Calculating this figure for each offer provides stark clarity about long-term costs.

Fees deserve careful scrutiny beyond their inclusion in APR. Origination fees, typically 1% to 8%, are deducted from your loan proceeds, meaning you receive less than you borrowed. Prepayment penalties, increasingly rare but still present with some lenders, charge fees if you pay off the loan early. Late payment fees and returned payment charges vary significantly between lenders. Admin fees or processing charges sometimes appear as separate line items.

Here’s a comparison table showing how different terms affect the total cost of a $10,000 loan at 8% APR:

| Loan Term | Monthly Payment | Total Interest Paid | Total Repayment |

| 36 months | $313 | $1,281 | $11,281 |

| 48 months | $244 | $1,720 | $11,720 |

| 60 months | $203 | $2,166 | $12,166 |

| 72 months | $175 | $2,614 | $12,614 |

| 84 months | $156 | $3,068 | $13,068 |

This table illustrates the fundamental financing trade-off: comfort today versus cost tomorrow. The 84-month term cuts your monthly payment in half compared to 36 months but nearly triples your total interest expense. Neither choice is inherently right or wrong, but understanding the trade-off allows you to make an informed decision aligned with your priorities and financial situation.

Create a simple spreadsheet or written comparison listing each lender vertically and these key metrics horizontally. This visual organization makes differences immediately apparent and often reveals that the lowest interest rate doesn’t always translate to the best overall deal once fees and terms are factored in.

Step 5: Finalize Your Application and Secure Funding

Once you’ve identified the optimal financing offer, moving from pre-qualification to funded loan involves several straightforward but important steps. Understanding what to expect streamlines the process and prevents delays.

Submit your full application with the chosen lender, providing accurate and complete information. Any discrepancies between your pre-qualification data and full application can trigger re-evaluation or delay approval. Gather documentation before applying to expedite the process. Most lenders require proof of identity like a driver’s license or passport, proof of income such as recent pay stubs or tax returns for self-employed borrowers, and bank statements showing your existing accounts and balances.

Employment verification confirms your job status and income level. Some lenders contact employers directly while others accept pay stubs and offer letters. Self-employed applicants typically face more documentation requirements, often needing two years of tax returns and sometimes profit-and-loss statements.

The lender performs a hard credit pull at this stage if they haven’t already, reviewing your full credit report for any red flags like recent delinquencies, high credit utilization, or other concerning patterns. Approval timelines vary by lender type, with online lenders often providing decisions within minutes to hours and funding within one to three business days. Traditional banks typically take two to five business days for approval and another few days for funding. Credit unions fall somewhere in between, usually processing applications within three to seven business days.

For personal loans, funds are deposited directly into your bank account as cash. You then have complete control over how to use those funds. You can negotiate with hot tub dealers as a cash buyer, often securing better pricing than you would as a financed buyer. Pay all your project vendors directly, including the dealer, electrician, and concrete contractor, maintaining complete transparency about where every dollar goes.

For dealer financing, the paperwork happens in the showroom with funds going directly to the dealer. This approach offers convenience but eliminates your cash buyer negotiating position. The financed amount typically covers only the hot tub and perhaps immediate accessories, excluding installation costs.

For home equity loans, the process mirrors getting a mortgage. After approval, you’ll attend a closing where you sign extensive paperwork and receive funds, either by check or direct deposit. The timeline from application to funding typically spans three to six weeks, making this the slowest option but potentially the lowest rate.

Regardless of which financing route you choose, read all loan documents carefully before signing. Verify that the APR, monthly payment, loan term, and fees match what you were quoted. Check for prepayment penalties that weren’t previously disclosed. Understand the payment schedule, due dates, and the lender’s policies on late payments. If anything seems unclear or doesn’t match your expectations, ask questions before signing rather than discovering problems later.

How to Get Hot Tub Financing with Bad Credit

A credit score below 650 doesn’t automatically disqualify you from hot tub financing, but it significantly narrows your options and increases costs. Approaching the situation strategically and with realistic expectations improves your chances of approval at terms you can manage.

Set Realistic Expectations

Lenders assess higher risk when extending credit to borrowers with challenged credit histories, and they offset that risk through higher interest rates and more restrictive terms. Where an excellent credit borrower might secure 7% APR, you might face 18% to 28% or higher. A $10,000 loan at 7% for 60 months costs $198 monthly with $1,881 in total interest. That same loan at 24% costs $283 monthly with $6,972 in total interest, nearly quadrupling your interest expense.

Loan amounts may be smaller than you request. A lender might approve you for $7,500 when you applied for $12,000, requiring you to either choose a less expensive hot tub or contribute a larger down payment. Terms may be shorter, pushing monthly payments higher even with a reduced loan amount.

Understanding these realities before applying prevents frustration and allows you to evaluate whether financing at available terms makes financial sense or whether improving your credit first represents the wiser path.

Actionable Strategies for Approval

Several tactical approaches can improve your approval odds and potentially secure better terms even with imperfect credit.

Finding a creditworthy co-signer represents one of the most effective strategies. A co-signer with good to excellent credit essentially lends you their credit profile, dramatically improving the lender’s risk assessment. Parents, siblings, or close friends sometimes agree to co-sign, though understand this creates significant obligation and risk for them. If you default or miss payments, their credit suffers equally, and the lender can pursue them for the full balance. Only ask someone to co-sign if you’re absolutely certain of your ability to make every payment on time.

Offering a larger down payment reduces the lender’s exposure and demonstrates your commitment to the purchase. If you can put 20% to 30% down, you’re borrowing less money and showing you have some financial discipline and savings capacity. A $10,000 hot tub with a $3,000 down payment means you’re only financing $7,000, making the lender more comfortable with approval and sometimes unlocking better rates.

Shopping for lenders specializing in subprime credit opens doors that mainstream banks keep closed. Online lenders like Avant, OneMain Financial, and Upgrade specifically serve borrowers with credit scores in the 580 to 660 range. Their rates are higher than prime lenders, but their underwriting criteria are more flexible, considering factors beyond just your credit score such as employment stability, income growth trajectory, and debt-to-income ratio.

Working with dealers who maintain relationships with multiple finance partners provides another avenue. Some dealers partner with subprime lenders specifically to serve customers with credit challenges. These dealers understand that approving you generates a sale they’d otherwise miss, creating motivation to find a lending solution. Be cautious, however, as these arrangements sometimes carry the highest interest rates and most aggressive terms. Never sign financing documents without understanding exactly what you’re agreeing to, regardless of how eager the dealer seems to help.

Considering a secured loan option changes the risk equation. If you own a vehicle outright, a title loan uses your car as collateral, typically offering better rates than unsecured options for borrowers with poor credit. The obvious risk is losing your vehicle if you default. Some lenders offer savings-secured loans where your own savings account secures the loan. You can’t access those funds until the loan is repaid, but rates drop dramatically when the lender holds your money as collateral.

Rebuilding Your Credit First

Sometimes the smartest financial decision is postponing your hot tub purchase for six to twelve months while actively improving your credit score. Even modest improvements can shift you into a better rate tier, potentially saving thousands of dollars in interest and making approval far more likely.

Pay down existing credit card balances aggressively, particularly those with high utilization rates. Credit utilization—the percentage of available credit you’re using—accounts for roughly 30% of your credit score. Bringing balances below 30% of your credit limits, and ideally below 10%, can boost your score by 20 to 50 points within a few months.

Make every payment on time without exception. Payment history represents 35% of your credit score, and even one late payment can drop your score significantly. Set up automatic payments for at least the minimum amount due on all accounts to ensure you never miss a due date.

Avoid opening new credit accounts in the months before applying for hot tub financing. Each new account application triggers a hard inquiry, and newly opened accounts lower your average account age, both temporarily suppressing your score. Let your credit profile stabilize for at least three to six months before applying for a significant loan.

Check your credit reports for errors and dispute any inaccuracies you find. The FTC estimates that one in five consumers has an error on at least one credit report. Incorrect late payments, accounts that don’t belong to you, or outdated negative information can all be disputed and potentially removed, providing an instant score boost.

If you’re recovering from bankruptcy, foreclosure, or other major credit events, time genuinely heals. These severe derogatory marks lose impact as they age. A bankruptcy from two years ago damages your score far more than one from six years ago. Waiting another year might move you from the “poor” category into “fair,” exponentially expanding your financing options.

The Hot Tub Payment Calculator: Estimating Your Monthly Cost

Understanding exactly what you’ll pay monthly before committing to financing prevents budget-breaking surprises and allows you to evaluate different scenarios to find the optimal balance between affordable payments and reasonable total costs.

Online loan calculators, available free from sources like Bankrate, NerdWallet, and most lender websites, require just three inputs to generate accurate estimates. Total loan amount represents everything you’re financing, including the hot tub, delivery, installation, and electrical work. Enter your comprehensive project budget figure rather than just the spa’s sticker price.

APR, or Annual Percentage Rate, includes both interest and fees, providing the true cost of borrowing. Use the APR from your pre-qualification offers rather than advertised rates, as your actual rate depends on your credit profile. If you’re still researching before getting pre-qualified, use conservative estimates based on your credit tier—perhaps 8% for excellent credit, 12% for good credit, 16% for fair credit, and 22% or higher for poor credit.

Loan term, entered in months, determines how long you’ll make payments. Common terms include 36, 48, 60, and 72 months, though some lenders offer options from 24 to 84 months. Running calculations across multiple terms reveals how term length affects both monthly payments and total interest.

Here’s an expanded comparison table showing monthly payments and total interest for various loan amounts, APRs, and terms:

$10,000 Loan

| APR | 36 Months | 60 Months | 72 Months |

| 7% | 308/mo(308/mo(1,104 interest) | 198/mo(198/mo(1,881 interest) | 171/mo(171/mo(2,312 interest) |

| 12% | 332/mo(332/mo(1,961 interest) | 222/mo(222/mo(3,346 interest) | 196/mo(196/mo(4,133 interest) |

| 18% | 361/mo(361/mo(2,991 interest) | 254/mo(254/mo(5,239 interest) | 230/mo(230/mo(6,534 interest) |

$15,000 Loan

| APR | 36 Months | 60 Months | 72 Months |

| 7% | 463/mo(463/mo(1,657 interest) | 297/mo(297/mo(2,821 interest) | 257/mo(257/mo(3,468 interest) |

| 12% | 498/mo(498/mo(2,942 interest) | 334/mo(334/mo(5,018 interest) | 295/mo(295/mo(6,199 interest) |

| 18% | 541/mo(541/mo(4,486 interest) | 380/mo(380/mo(7,859 interest) | 346/mo(346/mo(9,801 interest) |

These tables illustrate several critical insights. First, APR matters enormously—the difference between 7% and 18% on a $15,000 loan over 60 months is $5,038 in additional interest. Second, longer terms dramatically increase total interest even at the same APR. Third, borrowing more money compounds both effects, making the $15,000 loan at 18% for 72 months cost nearly $10,000 in interest alone.

Use these calculations to test different scenarios before committing. What if you saved for six more months and increased your down payment from $2,000 to $4,000, reducing your loan from $12,000 to $10,000? Running both scenarios through a calculator shows you the monthly payment difference and total interest savings, providing concrete data to inform your timeline decision.

Calculator tools also help you work backwards from budget constraints. If you know you can comfortably afford $250 monthly, input that payment amount along with available APRs to determine the maximum loan amount you can responsibly borrow at different terms. This reverse calculation prevents you from falling in love with a hot tub that’s financially out of reach and focuses your shopping on realistically affordable options.

Is Financing a Hot Tub a Good Investment?

The question of whether hot tub financing represents a sound financial decision requires separating traditional investment analysis from personal value assessment, as hot tubs deliver returns measured in wellness and lifestyle rather than monetary appreciation.

A Financial Perspective: Depreciation vs. Opportunity Cost

From a purely financial standpoint, hot tubs are depreciating assets similar to cars or appliances. A $10,000 hot tub loses 20% to 30% of its value the moment it’s installed and continues depreciating roughly 10% annually. After five years, your $10,000 hot tub might be worth $3,000 to $4,000 on the resale market, creating a negative return on capital.

Financing amplifies this depreciation reality because you’re paying interest on a declining asset. If you finance that $10,000 hot tub at 12% APR for 60 months, you’ll pay $13,346 total for an asset worth perhaps $4,000 when the loan is satisfied. The mathematical return is objectively negative.

Opportunity cost provides another lens. The $222 monthly payment on that financed hot tub could alternatively be invested in a diversified index fund averaging historical returns around 10% annually. Over those same 60 months, investing $222 monthly would grow to approximately $16,900, compared to owning a depreciating hot tub and having no cash. The wealth-building difference approaches $13,000 when accounting for both the investment growth and the hot tub’s depreciation.

These harsh financial realities explain why hot tubs should never be considered “investments” in the traditional sense. They don’t appreciate, generate income, or build wealth. Financing one means accepting negative financial returns in exchange for other benefits.

A Wellness Perspective: The ROI on Your Health

The value proposition shifts entirely when evaluating hot tubs through a wellness and quality of life framework. The health benefits of regular hydrotherapy are well-documented in medical literature and can deliver returns that, while not monetary, significantly improve daily living.

Chronic pain management represents one of the most compelling health benefits. The Arthritis Foundation recognizes warm water therapy as an effective tool for reducing joint pain and stiffness. The buoyancy of water reduces body weight by approximately 90%, relieving pressure on joints while warmth increases blood flow and relaxes muscles. For the estimated 54 million American adults with arthritis, regular hot tub use can reduce pain medication dependency and improve mobility.

Stress reduction and improved sleep quality offer mental health returns in our increasingly high-stress society. Research published in the International Journal of Aquatic Research and Education found that warm water immersion activates the parasympathetic nervous system, lowering cortisol levels and promoting relaxation. Regular evening hot tub sessions have been associated with improved sleep onset and quality, particularly for those with insomnia or stress-related sleep disruptions.

Consider the healthcare cost offset. If regular hot tub use reduces your need for physical therapy sessions at $100 to $150 each, prescription medications at $50 to $200 monthly, or even occasional massage therapy at $80 to $120 per session, the wellness returns begin offsetting ownership costs. A person spending $150 monthly on pain management alternatives who reduces those expenses by just 50% through hot tub therapy recoups $75 monthly, partially subsidizing the hot tub payment.

Family connection and relationship benefits carry value that defies financial quantification. A hot tub becomes a technology-free gathering space where families actually talk, couples reconnect without distractions, and friends enjoy quality time together. In an era where meaningful in-person interaction has declined dramatically, creating a dedicated space for genuine connection offers returns measured in relationship satisfaction and emotional well-being.

Physical fitness and recovery benefits appeal particularly to active individuals and athletes. Aquatic exercise in a swim spa or exercise-equipped hot tub provides low-impact cardiovascular workouts and strength training. Post-workout recovery sessions reduce muscle soreness and may accelerate healing, potentially allowing more consistent training and better fitness outcomes.

Dr. Bruce Becker, founder of the National Aquatics & Sports Medicine Institute, notes: “Warm water immersion creates a unique physiological environment that promotes healing, reduces pain perception, and enhances physical function. For many patients, the therapeutic benefits of regular hydrotherapy rival or exceed those achieved through pharmaceutical interventions, with none of the side effects.”

The investment question ultimately becomes personal: Do the wellness, lifestyle, and enjoyment benefits justify the financial costs in your specific situation? For a young couple building wealth with no health issues, the financial returns might not justify the expense, suggesting they should delay purchase. For a middle-aged person with chronic back pain spending significantly on symptom management, or a family prioritizing memorable experiences and quality time together, the non-financial returns can easily justify the financial costs.

The key is making an honest assessment of which category describes your situation while ensuring the financing you choose doesn’t create budget stress that undermines the relaxation and wellness benefits you’re purchasing the hot tub to achieve.

Key Takeaways for Financing Your Hot Tub

Successfully financing a hot tub requires balancing multiple considerations to find the approach that serves both your immediate desire for spa ownership and your long-term financial health. These essential points summarize the most important lessons from this comprehensive guide.

Calculate your true total cost before approaching lenders. The hot tub’s sticker price represents just 60% to 80% of your actual project budget. Include electrical installation, foundation preparation, delivery and placement, accessories, and a contingency buffer. Financing the comprehensive amount prevents cash flow problems midway through your project.

Check your credit score early in the process, ideally 30 to 60 days before shopping. Understanding where you stand allows realistic planning and potentially provides time to make improvements that unlock better rates. Remember that even a 20-point score increase can shift you to a lower interest tier, potentially saving thousands of dollars.

Compare multiple loan types rather than accepting the first approval you receive. Personal loans offer flexibility and cash-buyer status. Dealer financing provides convenience but may limit negotiating power. Home equity products deliver the lowest rates but involve your home as collateral. Each option serves different situations and priorities.

Read the fine print on promotional offers, particularly those advertising 0% APR. Deferred interest clauses can transform an attractive deal into your most expensive financing option if you fail to pay the balance before the promotional period ends. These deals work beautifully for disciplined borrowers who can and will pay in full by the deadline, but they’re financial traps for everyone else.

Choose a monthly payment you can comfortably afford while accounting for ownership costs. Your monthly budget must accommodate both the loan payment and ongoing expenses like electricity, chemicals, and eventual repairs. Financial stress undermines the wellness and relaxation benefits that motivated your purchase in the first place.

Consider the total interest paid, not just the monthly payment. A longer loan term reduces your monthly obligation but can double or triple your total interest expense. Understanding this trade-off allows you to make an informed decision aligned with your financial priorities.

Don’t let financing limitations push you toward an unaffordable purchase. If the financing available requires stretching beyond a comfortable budget, consider a less expensive model, delay the purchase while improving your financial position, or save for a larger down payment to reduce the financed amount.

Your Next Steps

Armed with comprehensive knowledge about hot tub financing options, costs, and strategies, you’re prepared to move forward confidently with your spa purchase. Begin by requesting your free credit report and checking your score to establish your baseline. Create a detailed budget spreadsheet calculating your true total project cost, including all installation and preparation expenses.

Start the pre-qualification process with at least three lenders representing different types: an online lender, your bank or credit union, and the dealer financing options available from your preferred retailer. Compare the offers using the metrics outlined in this guide, paying particular attention to APR, total interest paid, and any fees or restrictions.

Visit showrooms with your financing pre-qualification in hand, which positions you to negotiate effectively on price while knowing exactly what you can afford. When you find the right hot tub at the right price, you’ll be ready to move quickly with financing already arranged.

As you explore different hot tub models and sizes, understanding thebest sump pump for hot tub drainage can help you plan for proper water management and maintenance, ensuring your investment remains in excellent condition for years to come.

Your Hot Tub Financing Questions Answered

What credit score do I need to finance a hot tub?

A credit score of 680 or higher will qualify you for the best interest rates from most mainstream lenders, typically in the 7% to 12% APR range. However, financing options exist for scores as low as 600 and sometimes even lower. Expect interest rates to increase significantly as your score decreases, often reaching 18% to 28% or higher for scores below 650. Some specialized subprime lenders work with borrowers who have scores in the 550 to 600 range, though terms will be expensive.

Can you make monthly payments on a hot tub?

Yes, monthly payments are exactly how hot tub financing works. You secure a loan for the purchase amount, receive the funds to buy the hot tub, and then repay the lender through fixed monthly installments over a predetermined term, typically ranging from 24 to 84 months. This structure makes hot tub ownership accessible without requiring the full purchase price upfront, similar to how most people finance vehicles.

Is 0% financing for a hot tub a good deal?

Zero-percent financing can be an excellent deal, but only if you pay the entire balance before the promotional period expires. Most 0% offers operate on a deferred interest basis, meaning if you still owe anything when the promotional period ends, the lender retroactively applies interest to the original purchase amount from day one, typically at rates between 18% and 30%. If you’re disciplined enough to divide the total amount by the number of promotional months and consistently pay that amount or more, you’ll get genuinely free financing. If there’s any doubt about your ability to pay in full by the deadline, these promotions become financially dangerous and you’re better off with a traditional loan at a stated interest rate.

How much is a typical monthly payment for a hot tub?

Monthly payments vary significantly based on the hot tub’s total cost, your loan term, and your interest rate. For a mid-range $10,000 hot tub financed at 10% APR, you might pay approximately $212 monthly over 60 months or $318 monthly over 36 months. A more expensive $15,000 hot tub at the same rate would cost around $318 monthly over 60 months or $484 monthly over 36 months. Lower credit scores pushing interest rates to 18% or higher can increase these payments by $50 to $100 or more monthly.

Is it hard to get financing for a hot tub?

Getting financing for a hot tub is generally not difficult if you have a credit score above 680, stable employment, and reasonable debt-to-income ratio. The process closely resembles financing a major appliance or small vehicle. Most people with good credit and documented income qualify without issue. The challenge increases significantly with credit scores below 650, where approval becomes less certain and interest rates rise substantially. Even borrowers with challenged credit can often find financing through dealer partners or subprime lenders, though at considerably higher costs.

Can I finance the hot tub installation and electrical work too?

Yes, and doing so is strongly recommended to ensure you have sufficient funds for the complete project. A personal loan provides the best option for financing the comprehensive cost because you receive cash you can use for any purpose, including the hot tub itself, professional installation, electrical work, foundation preparation, and accessories. Most dealer financing programs cover only the spa unit and possibly immediate accessories, excluding installation labor and site preparation. Home equity loans and HELOCs also provide funds you can allocate across all project expenses.

Is it better to use a personal loan or dealer financing?

Personal loans typically offer more flexibility and often result in better overall value. You receive cash that covers your entire project including installation costs, and you approach the dealer as a cash buyer with stronger negotiating power on the purchase price. You can shop rates across multiple lenders to find the best terms for your credit profile. Dealer financing offers convenience with instant decisions and one-stop shopping, and occasionally features genuinely valuable promotional offers. However, dealer financing often limits your negotiating ability and may restrict you to higher prices or specific lending partners. For most buyers, securing a personal loan first and then negotiating the best cash price represents the optimal strategy.

How much of a down payment do I need for a hot tub?

Down payment requirements vary by lender and financing type. Many personal loans require no down payment at all, allowing you to finance 100% of your project cost if you qualify for a sufficient loan amount. Dealer financing similarly often requires zero down for qualified buyers, though putting 10% to 20% down can improve approval chances for those with marginal credit and may unlock better interest rates. Home equity loans don’t require down payments since your home equity serves as the loan basis. That said, making a substantial down payment of 20% to 30% reduces your monthly payment, lowers total interest paid, and demonstrates financial discipline that lenders reward with better terms.