Table of Contents - Lease to Own Hot Tub: Your Complete Guide to Affordable Spa Ownership in 2026

- What Is a Lease to Own Hot Tub Program

- How Lease to Own Hot Tubs Work

- Payment Structure and Terms

- Types of Hot Tubs Available Through Lease to Own Programs

- Benefits of Lease to Own Hot Tub Programs

- Drawbacks and Considerations of Lease to Own Hot Tubs

- Who Should Consider Lease to Own Hot Tub Programs

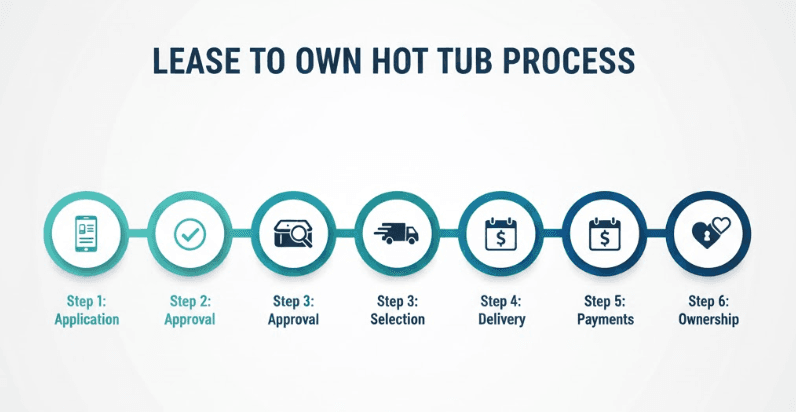

- Step-by-Step Guide to Getting a Lease to Own Hot Tub

- Top Lease to Own Hot Tub Companies and Providers

- Cost Breakdown: What to Expect When Leasing to Own a Hot Tub

- Lease to Own vs. Other Hot Tub Financing Options

- Common Mistakes to Avoid When Leasing to Own a Hot Tub

- Alternatives to Lease to Own Hot Tub Programs

- Frequently Asked Questions About Lease to Own Hot Tubs

- What credit score do I need for lease to own hot tub approval?

- How much does it cost per month to lease to own a hot tub?

- Can I return a hot tub if I can’t make the payments?

- Do lease to own hot tub payments build my credit?

- What happens at the end of my lease to own agreement?

- Are delivery and installation included in lease to own programs?

- Can I pay off my lease to own hot tub early?

This blog post may contain affiliate links. As an Amazon Associate I earn from qualifying purchases.

Imagine stepping into your own backyard oasis after a long day, letting warm, bubbling water melt away stress and tension. For many Americans, this dream feels financially out of reach when hot tubs carry price tags of $5,000 to $15,000 or more. That’s where lease to own hot tub programs have emerged as a genuine game-changer for homeowners who want spa luxury without draining their savings accounts.

A lease to own hot tub arrangement lets you make manageable monthly payments while enjoying your spa immediately, with ownership transferring to you once the final payment is complete. Unlike traditional financing that demands strong credit scores or rentals that never build equity, these programs offer a middle path that works for a surprisingly wide range of budgets and credit situations.

This comprehensive guide walks you through everything you need to know about leasing to own a hot tub. You’ll discover how these programs actually work, what they cost, which providers offer the best terms, and whether this financing approach makes sense for your specific situation. Whether you’re rebuilding credit, watching your cash flow, or simply prefer spreading costs over time, you’ll find the answers you need to make a confident, informed decision.

What Is a Lease to Own Hot Tub Program

A lease to own hot tub program is a financing arrangement that allows you to use a hot tub immediately while making monthly payments that eventually lead to full ownership. Think of it as a structured path to owning your spa without the burden of paying thousands of dollars upfront or qualifying for traditional bank financing.

These programs have grown increasingly popular across the United States, particularly among homeowners who may not have perfect credit or substantial savings but still want access to the therapeutic and lifestyle benefits of hot tub ownership. The model bridges the gap between outright purchasing and simple renting, offering advantages of both approaches.

Understanding Lease to Own Agreements

At its core, a lease to own agreement is a contract where you make regular monthly payments over a set period, typically ranging from twelve to forty-eight months. Unlike a standard rental where you’re simply paying for temporary use, a significant portion of each payment goes toward the eventual purchase of the hot tub.

The structure typically works like this: you apply with a lease to own provider, get approved based on factors beyond just your credit score, select your hot tub from available inventory, and begin making monthly payments. Throughout the lease period, you have full use of the spa in your home. When you complete all scheduled payments, ownership transfers completely to you.

Most agreements include an early buyout option, allowing you to pay off the remaining balance before the lease term ends. Many programs offer discounts for early payoff, sometimes reducing your total cost significantly if you can pay off the balance within the first ninety days or at other milestone points during the agreement.

How Lease to Own Differs from Other Financing Options

Understanding the distinctions between lease to own and other financing methods helps you evaluate whether this approach fits your circumstances. Each option carries different requirements, costs, and implications for your financial situation.

| Financing Method | Credit Requirements | Upfront Cost | Total Cost vs. Cash | Ownership Timeline |

| Cash Purchase | None | Full price | Lowest | Immediate |

| Traditional Financing | Good to Excellent (680+) | Down payment required | Moderate (interest) | After loan payoff |

| Lease to Own | Fair to Poor (500+) | Minimal to none | Higher (fees included) | After final payment |

| Personal Loan | Good (640+) | Varies | Moderate | Immediate |

| Credit Card | Must have available limit | None | Highest if not paid quickly | Immediate |

| Rental | None typically | First month | No ownership | Never |

Traditional financing through banks or credit unions typically offers lower interest rates but requires credit scores of 680 or higher. Lease to own programs accept applicants with scores as low as 500, and some approve customers with no credit history at all by considering factors like income stability and banking history.

The trade-off for this accessibility is cost. Lease to own programs generally result in paying more over time than you would with a cash purchase or traditional financing. However, for many consumers, this premium represents a reasonable price for accessibility and flexibility.

Key Terms and Components of Lease Agreements

Before signing any lease to own contract, familiarizing yourself with the terminology helps you understand exactly what you’re committing to and protects you from surprises down the road.

Buyout Option refers to your ability to purchase the hot tub before completing all scheduled payments. Most programs offer early buyout options at various points during the agreement, often with incentives for paying off sooner.

Residual Value is the calculated remaining worth of the hot tub at any point during the lease. This figure typically determines your early buyout amount and affects how much equity you’re building with each payment.

Payment Structure describes how your monthly amount breaks down between the lease fee (essentially the cost of the financing) and the portion applied toward eventual ownership. Some programs provide transparent breakdowns while others bundle everything into a single payment figure.

Default Consequences outline what happens if you miss payments or cannot continue the agreement. This may include late fees, negative credit reporting, repossession of the hot tub, and potential liability for remaining payments depending on the specific contract terms.

How Lease to Own Hot Tubs Work

The lease to own process follows a straightforward path from initial application to eventual ownership. Understanding each step helps you navigate the experience confidently and set realistic expectations for timeline and requirements.

Most lease to own transactions can be completed relatively quickly, sometimes within the same day as your initial application. This speed represents one of the primary appeals of these programs compared to traditional financing, which might take days or weeks for approval.

The Application and Approval Process

Starting your lease to own journey begins with finding a provider and submitting an application. You can apply through national lease to own companies that partner with hot tub dealers, directly through dealerships that offer in-house programs, or online through retailers with lease to own partnerships.

The application itself typically requires basic personal information including your name, address, date of birth, Social Security number, and contact details. You’ll also provide employment information, income details, and banking information in most cases.

Many lease to own companies perform what’s called a soft credit pull during initial approval. Unlike hard inquiries that can temporarily lower your credit score, soft pulls let the company assess your creditworthiness without impacting your score. This allows you to shop around and check approval at multiple providers without penalty.

Approval decisions often come within minutes for online applications. Some providers offer instant approval for qualified applicants, while others may need additional time to verify income or review your application manually if it falls outside their automated approval criteria.

Credit Requirements and Flexibility

One of the most significant advantages of lease to own programs is their accessibility to consumers who might not qualify for traditional financing. While conventional hot tub loans typically require credit scores of 680 or higher, lease to own programs routinely approve applicants with scores in the 500 to 600 range.

Several lease to own providers specifically market programs for customers with no credit history, limited credit, or past credit challenges. These companies evaluate applications using alternative data points including:

- Consistent employment history

- Stable and verifiable income

- Active checking account with regular deposits

- Residence stability

- Utility payment history

- Previous lease to own program history

If your initial application is declined, some providers offer reconsideration with additional documentation such as bank statements, pay stubs, or proof of other regular payments you’ve made responsibly.

Selecting Your Hot Tub

Once approved, you’ll choose your hot tub from available inventory. This is where lease to own programs sometimes differ from traditional purchasing experiences. Depending on the provider and dealer relationship, your selection may be limited compared to the full showroom inventory.

Some lease to own companies work with specific manufacturers or model lines, meaning you’ll choose from a curated selection rather than every available option. Others partner broadly with dealers and allow you to select from most in-stock models up to your approved spending limit.

When selecting your hot tub, consider these factors carefully:

Size and Capacity should match your typical usage. A couple might find a four-person model perfect, while families often prefer six to eight person capacity for gatherings.

Features and Jets vary significantly between models. If hydrotherapy for specific muscle groups matters to you, ensure your selection includes appropriate jet configurations.

Energy Efficiency affects your ongoing costs throughout ownership. More efficient models with better insulation and covers cost less to operate monthly.

Warranty Coverage during and after the lease term protects your investment. Understand what manufacturer warranty applies and how it transfers at ownership.

Payment Structure and Terms

Understanding exactly what you’re paying and for how long helps you budget appropriately and evaluate whether lease to own makes financial sense for your situation. Payment structures vary between providers, so comparing offers carefully matters.

The total amount you’ll pay through a lease to own agreement exceeds the cash purchase price, sometimes significantly. This premium covers the financing company’s risk, administrative costs, and profit margin. Viewing this markup as the cost of accessibility and payment flexibility helps frame whether the arrangement works for your circumstances.

Monthly Payment Breakdown

Your monthly lease payment typically includes several components bundled into a single figure. While providers don’t always break down these elements separately, understanding what you’re paying for helps you evaluate competitiveness.

The base payment covers your portion toward eventual ownership. This represents the retail value of the hot tub divided over your lease term, though it’s often calculated differently in practice.

Lease fees or rent charges constitute the cost of the financing arrangement itself. This is essentially what you’re paying for the privilege of making payments over time rather than purchasing outright.

Some programs include additional services in monthly payments such as warranty protection, damage liability coverage, or maintenance plan elements. Others charge these separately or require you to obtain coverage independently.

A typical mid-range hot tub with a retail price of $4,000 might carry monthly payments of $125 to $175 over a thirty-six month term, resulting in total payments between $4,500 and $6,300. The variance depends on your specific provider, credit profile, and any promotional offers available.

Contract Length Options

Lease to own agreements typically offer multiple term lengths, with longer terms reducing monthly payments but increasing total cost. Common options include:

Twelve-Month Terms offer the fastest path to ownership with the lowest total cost, but monthly payments are highest. This works well for buyers who want to minimize the financing premium and can handle larger monthly amounts.

Twenty-Four Month Terms balance payment size with total cost, representing a popular middle-ground option for many consumers.

Thirty-Six Month Terms bring monthly payments into more manageable territory for budget-conscious buyers, though you’ll pay more overall.

Forty-Eight Month Terms offer the lowest monthly payments but highest total cost. Extended terms make sense when monthly cash flow is tight, but you should calculate total outlay before committing.

Early Buyout and Payoff Options

Most lease to own programs include provisions for paying off your balance early, often with incentives that can substantially reduce your total cost. Understanding these options before signing helps you strategize for potential savings.

Ninety-Day Buyout options let you pay the remaining balance within the first three months for approximately the cash price of the hot tub plus a small administrative fee. If you can access funds within this window, you’ll avoid most of the lease financing costs.

Early Purchase Options at other points during your agreement typically calculate your buyout amount based on a schedule that decreases over time. The longer you wait, the more you’ve paid through regular payments, and the buyout amount adjusts accordingly.

Some providers offer promotional buyout discounts at specific intervals, such as six months, twelve months, or halfway through your term. Ask about these milestone discounts when evaluating different lease to own offers.

Delivery, Installation, and Setup

What’s included with delivery and installation varies significantly between lease to own arrangements. Some programs bundle comprehensive delivery and setup into the agreement, while others charge these as additional fees.

Standard delivery typically includes transportation of your hot tub from the dealer or warehouse to your property and placement at your designated location. This service usually ranges from $200 to $500 depending on distance and complexity.

Full installation services go beyond basic delivery to include electrical connection, leveling, initial water filling, and system startup. Professional installation commonly costs $500 to $1,500 depending on electrical requirements and site preparation needs.

When comparing lease to own offers, clarify exactly what’s included and what costs extra. A seemingly lower monthly payment might not include services that another provider bundles in, affecting your true total cost.

Ownership Transfer Process

Once you’ve completed all scheduled payments or exercised an early buyout option, ownership of your hot tub transfers fully to you. This process typically happens automatically but involves several components.

Your lease provider will send confirmation that the agreement is complete and satisfied. This documentation serves as proof of ownership and your right to the property.

Any manufacturer warranty still in effect transfers to you as the owner. Most hot tub warranties span five to seven years on major components, so you may have substantial coverage remaining after a shorter lease term.

Registration with the manufacturer may be required to activate or continue warranty coverage under your name. Your dealer or lease provider typically guides you through this process.

At this point, you own the hot tub outright with no further obligations to the leasing company. You’re free to sell, trade, modify, or continue enjoying your spa as you see fit.

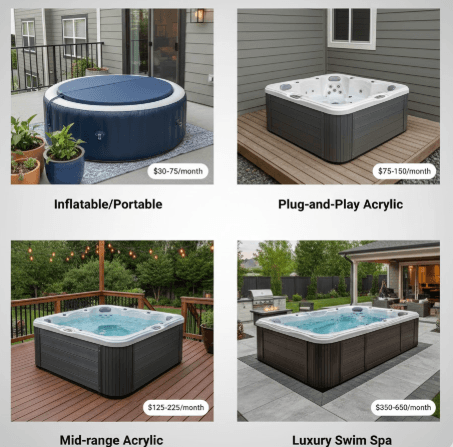

Types of Hot Tubs Available Through Lease to Own Programs

The range of hot tubs available through lease to own financing spans from budget-friendly portable units to luxury models with premium features. Understanding what’s available at different price points helps you match your selection to both your needs and your budget.

Availability varies by provider and dealer partnership, so the specific models accessible to you depend on where you apply and your approved spending limit. However, most programs offer options across these general categories.

Entry-Level and Portable Hot Tubs

Entry-level options make hot tub ownership accessible at the lowest monthly payment levels. These models suit buyers primarily seeking affordability, those with limited space, or first-time owners wanting to test whether hot tub lifestyle fits their routines.

Inflatable Hot Tubs represent the most affordable category, with monthly lease payments typically ranging from $30 to $50 over standard terms. While they lack the durability and features of permanent models, modern inflatables offer surprisingly comfortable experiences for their price point.

Plug-and-Play Models don’t require special electrical installation, operating from standard household outlets. These units typically seat two to four people comfortably and carry monthly payments of $50 to $75. They’re particularly appealing for renters or those uncertain about long-term hot tub commitment.

Features at this level are basic but functional, including simple jet configurations, standard heating, and fundamental controls. Don’t expect advanced hydrotherapy, extensive lighting, or sophisticated water management systems in entry-level models.

Mid-Range Hot Tubs

The mid-range category represents the sweet spot for most lease to own customers, balancing meaningful features with reasonable monthly commitments. These models deliver genuine spa experiences with durability suitable for years of regular use.

Five to Six Person Acrylic Models dominate this category, offering proper spa construction with insulated shells, quality jet systems, and improved energy efficiency. Monthly payments typically fall between $100 and $175 for these units.

Features commonly included at mid-range levels:

- Multiple jet configurations targeting different muscle groups

- LED lighting with color options

- Digital control panels

- Quality cover and lift systems

- Improved insulation for energy efficiency

- Built-in filtration and water management

Popular brands available through many lease to own programs at this level include Sundance, Caldera, Hot Spring’s entry and mid-tier lines, and various regional manufacturers. When exploring hot tub tips for first-time buyers, mid-range models often provide the best value proposition.

Premium and Luxury Hot Tubs

Premium models deliver the ultimate spa experience with advanced features, superior construction, and sophisticated technology. While monthly payments climb accordingly, buyers seeking the best available experience find these investments worthwhile.

Seven Plus Person Models with premium construction carry monthly lease payments typically ranging from $175 to $300 or higher. These spas serve as backyard centerpieces with features that rival professional spa facilities.

Luxury features commonly found at this level include:

- Advanced hydrotherapy jet systems with multiple massage modes

- Smartphone connectivity and app control

- Premium sound systems with Bluetooth integration

- Dramatic lighting packages with water features

- Advanced water purification including UV or ozone systems

- Superior insulation and energy management

- Extended warranties on components

Brands like Jacuzzi, premium Hot Spring collections, Bullfrog Spas, and high-end Marquis models fall into this category. These represent significant investments even through lease to own arrangements, so carefully evaluate whether premium features justify the additional cost.

Swim Spas and Hybrid Models

Swim spas combine hot tub relaxation with swimming and exercise capabilities in a single unit. These larger installations carry correspondingly higher monthly payments but offer dual functionality that might otherwise require separate pools and spas.

Standard Swim Spas typically measure twelve to fifteen feet in length and include powerful swim currents along with traditional hot tub seating areas. Monthly payments through lease to own programs commonly range from $300 to $500.

Dual-Temperature Models maintain separate zones for swimming (cooler temperatures around 80-84°F) and soaking (warmer temperatures around 100-104°F). This configuration allows simultaneous use for different purposes without compromise.

Lease terms for swim spas often extend to forty-eight or even sixty months to keep monthly payments manageable given the higher total investment. The longer commitment should factor into your decision, particularly if your living situation might change.

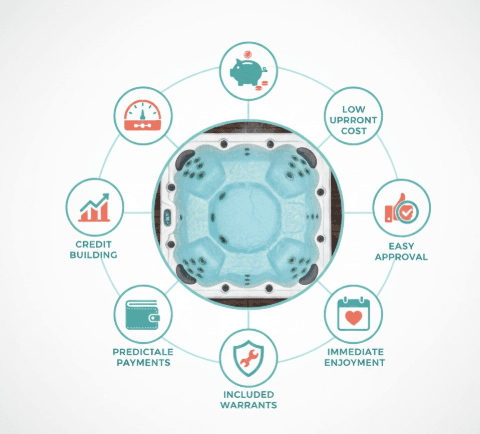

Benefits of Lease to Own Hot Tub Programs

Lease to own arrangements offer genuine advantages for many buyers, particularly those who might struggle with traditional financing requirements or prefer to spread costs over time. Understanding these benefits helps you evaluate whether the approach aligns with your priorities and circumstances.

The value proposition differs for every buyer. What represents a compelling benefit to one person might matter less to another. Consider which advantages apply most directly to your situation when weighing your options.

Lower Upfront Costs

Perhaps the most significant benefit of lease to own is the minimal cash required to get started. While purchasing a hot tub outright demands $5,000 to $15,000 or more, lease to own programs typically require only the first month’s payment and potentially a small application fee.

This accessibility means you can enjoy your hot tub immediately without depleting savings accounts, emergency funds, or other financial reserves. For many families, keeping those funds available for unexpected expenses while still enjoying lifestyle improvements represents meaningful value.

The first month payment typically ranges from $50 to $250 depending on your selected model, compared to thousands of dollars for outright purchase. This difference can determine whether hot tub ownership is immediately achievable or requires years of saving.

Flexible Approval and Credit Options

Traditional financing approval can feel like an exclusive club with strict membership requirements. Lease to own programs open doors for consumers who might not otherwise qualify for credit-based purchases.

If you’re working with credit scores below 650, recovering from past financial difficulties, building credit for the first time, or simply prefer not to undergo hard credit inquiries, lease to own provides a path forward. The alternative approval criteria used by these programs evaluate your current financial stability rather than focusing exclusively on credit history.

Self-employed individuals, gig workers, and others with non-traditional income sources often find lease to own approval easier to obtain than conventional financing, where proof of steady employment typically carries heavy weight.

Try Before You Fully Commit

Lease to own arrangements reduce the risk of committing thousands of dollars to something you might regret. While returning a hot tub mid-lease isn’t free or simple, it’s generally more feasible than selling a model you purchased outright.

This trial period aspect particularly benefits first-time hot tub owners uncertain whether they’ll actually use the spa regularly. You can experience ownership for several months before the majority of your payments have been made, giving you real data on whether the lifestyle suits your routines.

Some programs offer return or exchange options within specific windows, though terms vary significantly. Review your contract carefully to understand what flexibility exists if you determine the hot tub isn’t right for you.

Included Maintenance and Warranty Coverage

Many lease to own programs include service coverage or warranty protection during the lease term. This bundled protection can represent substantial value, particularly for buyers concerned about repair costs during the period before they fully own the equipment.

Service coverage typically addresses mechanical failures, pump issues, heating element problems, and control system malfunctions. Some programs extend this to include cover replacement, minor cosmetic repairs, or annual maintenance visits.

During the lease period, you’re not fully responsible for a major component failure that might cost hundreds or thousands to repair. This shared risk represents meaningful value that partially offsets the premium you’re paying for lease to own financing.

Budget-Friendly Monthly Payments

Predictable monthly payments simplify household budgeting compared to saving unpredictable amounts toward a future purchase. You know exactly what you’ll pay each month, making it easier to plan other expenses around your hot tub commitment.

Spreading the cost across two, three, or four years transforms a major purchase into a manageable monthly expense similar to a streaming service, gym membership, or other regular lifestyle expenditure. Many buyers find $100 to $200 monthly easier to absorb than finding $6,000 or more at once.

This predictability extends through the entire agreement, protecting you from payment surprises as long as you maintain the account in good standing and avoid late fees.

Immediate Enjoyment and Use

There’s no waiting period with lease to own. Once approved and delivered, your hot tub is ready for use. You don’t need to save for months or years before experiencing the benefits of hot tub ownership.

The health and wellness benefits of hot tub use begin immediately. Stress relief, muscle relaxation, improved sleep, joint pain reduction, and quality family time don’t require you to wait until some future date when you’ve accumulated enough savings.

For buyers with immediate therapeutic needs, whether recovering from injury, managing chronic pain conditions, or seeking stress relief during challenging life periods, this immediate access carries real value beyond simple convenience.

Potential Tax Benefits for Business Use

In certain situations, lease payments for hot tubs may offer tax advantages. Rental property owners adding hot tubs to vacation rentals, wellness practitioners using hydrotherapy in their practices, and home-based businesses with legitimate therapeutic applications might find deductible expenses.

If your hot tub serves a genuine business purpose, consult with a qualified tax professional about potential deductions. The lease payment structure may provide tax treatment advantages compared to purchasing in some circumstances, though this varies based on your specific situation and current tax regulations.

Drawbacks and Considerations of Lease to Own Hot Tubs

Honest evaluation requires acknowledging the downsides alongside benefits. Lease to own arrangements carry genuine disadvantages that matter more or less depending on your circumstances and priorities. Understanding these limitations helps you make a fully informed decision.

For some buyers, these drawbacks represent deal-breakers that should steer them toward alternative approaches. For others, they’re acceptable trade-offs for the benefits received. Only you can determine which category applies to your situation.

Higher Total Cost Compared to Cash Purchase

The most significant drawback of lease to own is the premium you’ll pay compared to outright purchase. This reality cannot be ignored when evaluating whether the approach makes financial sense.

Consider a mid-range hot tub with a cash price of $4,500. Through a typical thirty-six month lease to own agreement at $150 monthly, you’ll pay $5,400 total, a premium of $900 or twenty percent above retail price.

For higher-end models and longer terms, this premium can be substantial. A $7,000 hot tub leased over forty-eight months at $200 monthly totals $9,600, representing a thirty-seven percent markup over the cash purchase price.

Whether this premium represents acceptable cost depends on your alternatives. If the choice is between lease to own at twenty percent over retail or not having a hot tub at all, many buyers find the arrangement worthwhile. If you could realistically save and purchase outright within a reasonable timeframe, that approach saves money.

Contract Obligations and Commitment

Signing a lease to own agreement creates a legal obligation that’s difficult and often expensive to exit early. Unlike a subscription you can cancel with a phone call, ending a lease to own contract before completion typically involves penalties, fees, or continued payment requirements.

If your financial circumstances change unexpectedly through job loss, illness, divorce, or other life events, you may find yourself committed to payments you can no longer comfortably afford. While most agreements include some provisions for hardship or early termination, these rarely let you walk away without cost.

Missing payments can trigger default provisions including late fees, collection activities, negative credit reporting, and potential repossession of the hot tub. The flexibility of entry doesn’t extend to flexibility of exit in most cases.

Limited Model and Brand Selection

When shopping for a hot tub to purchase outright, you have access to every model from every brand your dealer carries. Lease to own arrangements often restrict your choices to specific inventory, manufacturers, or model lines.

Some lease to own companies work exclusively with particular brands or have agreements limiting which models qualify for their financing. Others cap spending limits for new customers, potentially excluding premium models from consideration.

This restriction may mean your ideal hot tub isn’t available through the lease to own program you qualify for. You might need to compromise on features, capacity, or brand to work within available options.

Potential Hidden Fees

The advertised monthly payment rarely tells the complete cost story. Various fees can add to your total expense in ways that aren’t immediately obvious when evaluating offers.

Application Fees charged by some providers range from $25 to $75 simply to process your initial request.

Delivery Fees often apply separately from your lease payment, adding $200 to $500 to your total cost.

Installation Charges for electrical work and setup frequently aren’t included, potentially adding $500 to $1,500 to your expenses.

Late Payment Fees punish missed or delayed payments with charges typically ranging from $15 to $50 per occurrence.

Insurance or Protection Plans may be required or strongly encouraged, adding monthly costs beyond your base payment.

Early Termination Penalties apply if you need to exit the agreement before completing all payments.

Requesting a complete breakdown of all fees and charges before signing helps you understand your true total commitment. Don’t rely solely on the advertised monthly payment when budgeting.

Credit Impact of Lease Agreements

The relationship between lease to own arrangements and your credit profile is complicated and varies by provider. Some companies report payment history to credit bureaus, potentially helping you build credit through responsible payments. Others don’t report at all, meaning your on-time payments won’t boost your credit score.

What’s consistent is the negative impact of defaults and collections. If you fall behind on payments or default on the agreement, this information likely will reach your credit reports, potentially damaging your score significantly.

Before signing, ask specifically whether the provider reports to credit bureaus and how. If building credit is important to you, this factor might influence which provider you choose.

You Don’t Own It Until Final Payment

Throughout the lease term, the hot tub belongs to the leasing company, not you. This creates limitations that wouldn’t apply if you owned the spa outright.

You typically cannot make significant modifications, alterations, or customizations to equipment you don’t own. Want to upgrade the cover, add accessories, or make repairs with aftermarket parts? Your lease agreement may restrict these options.

Relocating presents challenges when you don’t own the equipment. Moving to a new home might require notifying the lease company, potentially transferring the agreement, or facing restrictions on taking the hot tub with you.

If you’ve made twenty payments on a thirty-six month lease and then default, you don’t own two-thirds of a hot tub. You own nothing, and may lose the unit entirely through repossession while still owing additional amounts depending on your contract terms.

Maintenance Responsibilities and Restrictions

While some lease programs include maintenance coverage, you remain responsible for routine care and potentially liable for damage beyond normal wear. Understanding these obligations protects you from unexpected costs or disputes.

Required maintenance typically includes regular water treatment, filter cleaning and replacement, cover care, and winterization if applicable in your climate. Neglecting these responsibilities could void any included warranty coverage and make you liable for resulting damage.

Damage liability during the lease period means you may owe for repairs or replacement if the hot tub is damaged through improper use, neglect, or accidents. Some agreements require you to maintain insurance coverage protecting against such damage.

Prohibited modifications are common in lease agreements. You may be restricted from making changes that could affect the hot tub’s value or condition, even improvements you’d make freely to equipment you owned.

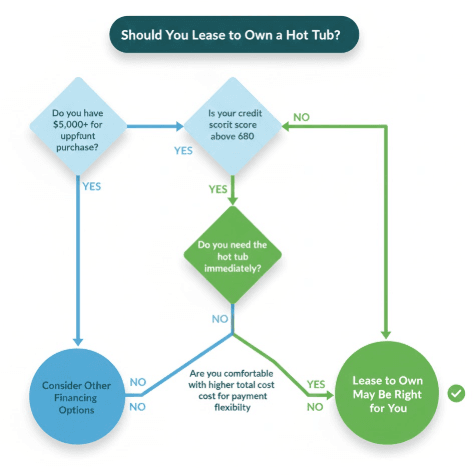

Who Should Consider Lease to Own Hot Tub Programs

Lease to own works better for some buyers than others. Matching your circumstances and priorities to the appropriate financing approach helps ensure you’re making a choice that serves your interests.

The ideal lease to own customer benefits from the accessibility and flexibility these programs offer while accepting the higher total cost as a reasonable trade-off. Consider whether your situation aligns with these common profiles.

Homeowners with Limited Savings

If you have stable income but limited cash reserves, lease to own lets you enjoy a hot tub without depleting the savings you do have. Maintaining emergency funds while adding lifestyle improvements makes sense for many households.

Rather than spending $5,000 or more from savings that might be needed for unexpected expenses, you preserve that financial cushion while making manageable monthly payments. The security of having accessible savings may outweigh the premium paid for lease financing.

This approach works best when you’re confident about your income stability over the lease term. Monthly payments require consistent income, so uncertainty about future earnings should give you pause.

Individuals Building or Rebuilding Credit

Lease to own programs that report to credit bureaus can help establish or improve your credit profile through responsible payment history. If you’re working to build credit, these payments represent an opportunity.

Making consistent, on-time payments demonstrates creditworthiness to future lenders. Over a two or three year lease term, this positive history can meaningfully impact your credit score and qualify you for better financing options on future purchases.

Not all lease to own companies report payments, so specifically verify this feature if credit building is a priority. Ask whether they report to one or all three major credit bureaus.

First-Time Hot Tub Buyers

If you’ve never owned a hot tub, lease to own reduces the risk of a major purchase you might regret. The lower initial commitment compared to outright purchase provides something of a trial period.

First-time owners don’t always accurately predict their usage patterns. Some discover they use their hot tub daily and wish they’d purchased sooner. Others find the maintenance requirements tedious or their usage sporadic after initial excitement fades.

Lease to own lets you experience ownership before committing the majority of the total cost. While you can’t simply return the hot tub without consequences, you’ll learn whether ownership suits your lifestyle before years of payments are behind you.

Renters and Temporary Homeowners

If you’re not certain how long you’ll remain at your current address, lease to own offers more flexibility than purchasing outright. Some programs allow lease transfers or have provisions for relocation situations.

Portable and plug-and-play models available through many lease programs can move with you more easily than permanently installed spas. This portability suits renters who may relocate when leases end.

However, carefully review your lease agreement regarding relocation. Some contracts restrict moving the hot tub or require approval, and others may trigger acceleration of remaining payments if you move.

People Wanting Immediate Access Without Large Investment

Sometimes the desire for immediate enjoyment outweighs financial optimization. If you want a hot tub now rather than in two years when you’ve saved enough, lease to own makes it happen.

The therapeutic benefits, family enjoyment, and lifestyle improvements don’t wait for future dates. Lease to own transforms “someday” into “this week” for buyers prioritizing immediate experience over long-term cost minimization.

This motivation makes perfect sense for many people, provided you go in understanding the true costs and accept the trade-off consciously rather than discovering it later.

Step-by-Step Guide to Getting a Lease to Own Hot Tub

Understanding the process from research through ownership helps you navigate efficiently and avoid common pitfalls. This step-by-step walkthrough covers what to expect and how to prepare at each stage.

Taking time upfront to research options, understand costs, and prepare properly pays dividends throughout your lease term. Rushing into agreements without adequate preparation leads to regret more often than careful, informed decision-making.

Research and Compare Lease to Own Providers

Begin by identifying available lease to own options in your area and evaluating their terms. Multiple providers often serve the same markets, and their terms can vary significantly.

National lease to own companies like Acima, Progressive Leasing, and Snap Finance partner with hot tub dealers across the country. These companies specialize in lease to own financing and typically offer competitive terms and established processes.

Local and regional dealers sometimes offer in-house financing programs or partnerships with smaller finance companies. These arrangements may offer more flexibility and personalized service.

Online retailers including major warehouse clubs partner with lease to own providers for purchases through their platforms. If buying online appeals to you, verify what lease options are available.

Compare these factors across providers:

- Credit requirements and approval likelihood

- Monthly payment amounts for similar hot tub models

- Total cost over the full term

- Early buyout options and discounts

- Included services and warranties

- Customer reviews and reputation

- Fees beyond the monthly payment

Check Your Budget and Calculate Affordability

Before applying, honestly evaluate what monthly payment you can sustain over the full lease term. Consider not just the lease payment but all costs associated with hot tub ownership.

Your monthly budget should accommodate:

- Lease payment based on your target hot tub and term length

- Electricity costs typically adding $20 to $50 monthly

- Water and chemicals averaging $20 to $40 monthly

- Incidental maintenance budgeting perhaps $10 to $20 monthly for filters and supplies

If the total monthly obligation strains your budget, consider a less expensive model, shorter term with higher payments but lower total cost, or waiting until your financial situation improves.

Calculate total cost over the full term to understand what you’re actually paying. Multiply monthly payment by number of months, then add any fees, delivery charges, and installation costs. Compare this figure to outright purchase price to understand the lease premium.

Review Contract Terms Carefully

Before signing any lease agreement, read the complete contract thoroughly. Understanding every provision protects you from surprises and ensures the arrangement matches your expectations.

Pay particular attention to:

Total Payment Amount including all scheduled payments over the full term. This figure reveals the true cost of your financing.

Early Buyout Schedule showing what you’d pay to own the hot tub at various points during the agreement. Note any discount windows offering favorable payoff terms.

Fees and Penalties for late payments, returned payments, early termination, or other circumstances. These can add meaningfully to your costs if triggered.

Insurance Requirements specifying what coverage you must maintain during the lease term. Factor this expense into your total cost calculation.

Maintenance Obligations defining your responsibilities for care and upkeep. Understand what’s expected and potential consequences of neglect.

Warranty Coverage clarifying what protection applies during the lease and how it transfers at ownership.

Return and Termination Provisions explaining your options and costs for ending the agreement early. Understand these thoroughly in case your circumstances change.

Prepare Required Documentation

Gathering necessary documentation before applying streamlines the process and avoids delays. Requirements vary by provider but commonly include:

Proof of Income such as recent pay stubs, bank statements showing deposits, tax returns for self-employed applicants, or benefit statements for social security or disability income.

Personal Identification including a valid driver’s license, state ID, or passport. Most providers require government-issued photo identification.

Residence Verification through utility bills, lease agreements, or other documents showing your current address matches your application.

Banking Information including account and routing numbers for automatic payment setup. Some providers require active checking accounts as an approval criterion.

Having these ready when you apply reduces back-and-forth and speeds approval. Some providers offer faster decisions for applicants who can verify information immediately.

Submit Your Application

With research complete and documentation ready, submit your application through your chosen provider. Most lease to own companies offer both online and in-store application options.

Online applications provide convenience and often faster initial decisions. You can typically complete the application in ten to fifteen minutes from home and receive approval status quickly, sometimes within minutes.

In-store applications at dealer locations offer personal assistance and the ability to ask questions. Sales staff familiar with the lease programs can guide you through requirements and options.

If your initial application is declined, ask about the reason and whether reconsideration is possible with additional documentation. Some providers approve applications on second review with additional income verification or other supporting information.

Select Your Hot Tub Model

With approval in hand, you’ll choose your specific hot tub. Your selection should balance desired features with approved spending limits and monthly budget constraints.

Consider visiting dealer showrooms to see and ideally try models before selecting. Sitting in a filled, operating hot tub gives much better sense of fit and comfort than viewing empty display models.

Questions to answer when selecting:

- Does capacity match your realistic usage (immediate family, entertaining, therapy focus)?

- Do jet configurations address your priorities (back, shoulders, legs, feet)?

- Will the model fit your intended installation location with adequate clearance?

- Is electrical supply adequate, or will upgrades be needed?

- Does energy efficiency minimize ongoing operating costs?

- Does warranty coverage meet your expectations?

Take time with this decision. You’ll live with your selection throughout the lease term and beyond. Rushing leads to regrets that cost money and hassle to address.

Schedule Delivery and Installation

With your hot tub selected, coordinate delivery and installation. This stage requires preparation on your end to ensure smooth arrival and setup.

Site Preparation includes ensuring level foundation adequate for hot tub weight when filled with water and occupants. Options include concrete pads, reinforced decks, or compacted gravel bases depending on your model and location.

Access Considerations matter for delivery. Measure gates, pathways, and any turns the hot tub must navigate. Many installations require removal of fence sections or crane lifts for awkward access situations.

Electrical Requirements vary by model. Portable plug-and-play units need only a standard outlet, while most permanent installations require dedicated 220-volt circuits installed by licensed electricians. Verify requirements and arrange electrical work before delivery.

Permits may be required in your jurisdiction for electrical work or permanent hot tub installations. Check local requirements to avoid compliance issues.

Coordinate delivery timing when you can be present for the entire process. Installers need owner access and decisions during setup.

Complete Setup and Orientation

Once delivered and positioned, your hot tub requires initial setup before first use. Take advantage of any training provided to understand your specific model’s operation and care requirements.

Initial Filling with clean water is straightforward but takes time depending on your water pressure and hot tub capacity. Position your hose properly to fill through the filter canister, reducing airlock issues.

Water Treatment begins immediately with balancing chemistry. Your installer or dealer should provide initial chemicals and guidance on establishing proper levels for pH, alkalinity, and sanitizer.

Control Panel Training familiarizes you with temperature adjustment, jet operation, filtration cycles, and diagnostic features. Understanding your control system avoids frustration later.

Maintenance Schedule discussions establish routines for filter cleaning, water testing, chemical addition, and periodic drain-and-refill cycles. Ask about frequency recommendations for your specific model and usage patterns.

Safety Orientation covers water temperature limits, alcohol precautions, child supervision requirements, and emergency shutoff procedures. Understanding these protects your family and guests.

Maintain Regular Payments and Care

With your hot tub operational, establishing consistent routines for payments and maintenance protects your investment and credit standing while maximizing enjoyment.

Payment Setup through automatic bank drafts or credit card charges ensures on-time payment without requiring monthly attention. Most lease companies offer autodraft options that prevent accidental missed payments.

Payment Records should be maintained throughout your lease term. Keep confirmation emails, bank statements, and any correspondence with the lease company. This documentation protects you if disputes arise.

Maintenance Routines including weekly water testing, monthly filter cleaning, and regular cover care keep your hot tub operating properly. Neglecting maintenance leads to equipment damage, poor water quality, and potential repair costs.

Documentation of your maintenance activities may prove valuable if warranty claims arise. Photos and notes about care provided demonstrate responsible ownership.

Top Lease to Own Hot Tub Companies and Providers

Several major companies dominate the lease to own market for hot tubs, each with somewhat different terms, requirements, and approaches. Understanding your options helps you select the best fit for your circumstances.

The best provider for you depends on your credit profile, local dealer partnerships, desired hot tub model, and term preferences. Research multiple options before committing.

National Lease to Own Finance Companies

These companies partner with hot tub dealers nationwide, offering consistent programs regardless of location.

Acima Leasing

Acima represents one of the largest lease to own providers with partnerships at thousands of retail locations including many hot tub dealers. Their program focuses on accessibility for customers with limited credit.

Approval Requirements emphasize income and banking stability rather than credit scores. Many applicants with challenged credit find approval through Acima when traditional financing isn’t available.

Typical Terms span twelve months as the standard agreement length. Monthly payments are calculated to pay off the retail price plus fees over this period.

Early Purchase Options include a 90-day same-as-cash window where you can buy out for essentially retail price plus a small fee. Additional discounts apply at other intervals during the lease term.

Finding Participating Dealers is straightforward through Acima’s store locator or by asking hot tub dealers directly whether they accept Acima financing.

Progressive Leasing

Progressive Leasing serves customers across major retailers and smaller specialty dealers, including many in the hot tub industry. Their flexible terms and widespread acceptance make them a common option.

Approval Rates tend to be high for applicants with steady income, even with poor or no credit history. Progressive emphasizes current financial stability over past credit challenges.

Payment Flexibility includes options to pay weekly, biweekly, or monthly based on your pay schedule. This alignment with income timing helps avoid payment difficulties.

Twelve Month Standard Terms with early purchase discounts at 90 days and periodically throughout the agreement reduce total cost for those who can pay off sooner.

Retailer Partnerships include major chains and independent dealers. Ask your preferred hot tub seller whether Progressive is an option.

Snap Finance

Snap Finance specifically markets to customers who don’t qualify for traditional financing, offering high approval rates and flexible terms.

Alternative Approval uses bank account data rather than credit scores as the primary qualification factor. Regular direct deposits and stable account history drive approval decisions.

100-Day Payoff Option allows you to pay the original cash price plus a $50 fee within the first hundred days, avoiding most financing costs. This window exceeds the 90-day period offered by some competitors.

Term Lengths extend up to eighteen months for standard leases, with monthly payments calculated accordingly.

Participating Locations include many hot tub dealers nationwide. Verify availability with your preferred seller.

Hot Tub Manufacturers and Dealers Offering In-House Programs

Some hot tub brands and dealers offer financing directly rather than through third-party lease companies.

Bullfrog Spas dealers sometimes offer proprietary financing programs with competitive terms for qualified buyers. These programs vary by dealer location and promotional periods.

Hot Spring and Caldera dealers frequently participate in manufacturer-backed financing promotions including deferred interest offers and reduced rate programs. While often requiring better credit than lease to own, these can offer lower total costs.

Jacuzzi authorized dealers typically offer multiple financing tiers including options for various credit levels. Manufacturer programs may provide better terms than third-party lease companies for those who qualify.

Local Dealer Programs developed independently by individual dealers can offer flexibility and personalized terms not available through national programs. Building a relationship with a local one hot tub specialist may unlock options beyond standard offerings.

Regional and Local Hot Tub Dealers

Independent dealers in your area may offer advantages beyond what national programs provide, including:

- Personalized credit evaluation and flexibility

- Package deals including delivery, installation, and accessories

- Ongoing service relationships

- Local reputation accountability

- Negotiable terms and pricing

Finding local options requires direct outreach. Search for hot tub dealers in your area and ask specifically about lease to own or alternative financing for customers with credit challenges.

Online Marketplaces and Retailers

Major retailers including Costco, Sam’s Club, and various online hot tub sellers partner with lease to own companies for financing.

Warehouse Club Options through Costco and Sam’s Club often include lease to own through partners like Affirm or Snap. Selection may be more limited than specialty dealers, but pricing can be competitive.

Online Hot Tub Retailers sometimes offer lease to own through various finance partners. Shipping considerations and installation coordination make these purchases more complex than local dealer transactions.

When buying a hot tub online with lease financing, carefully verify:

- Delivery arrangements to your specific location

- Installation coordination or requirements

- Warranty service availability in your area

- Return procedures if issues arise

Cost Breakdown: What to Expect When Leasing to Own a Hot Tub

Understanding realistic cost expectations helps you budget appropriately and evaluate whether lease to own fits your financial situation. Costs vary significantly based on hot tub selection, lease terms, and provider.

The figures below represent typical ranges based on current market conditions. Your actual costs may differ based on your specific circumstances and selections.

Monthly Payment Ranges by Hot Tub Type

Your monthly payment depends primarily on the retail price of your selected hot tub and your lease term length.

| Hot Tub Category | Retail Price Range | Typical Monthly Payment | Common Term |

| Inflatable/Entry | $400-$1,500 | $30-$75 | 12-24 months |

| Plug-and-Play | $2,000-$4,000 | $75-$150 | 24-36 months |

| Mid-Range Acrylic | $4,000-$8,000 | $125-$225 | 24-48 months |

| Premium | $8,000-$15,000 | $200-$350 | 36-48 months |

| Swim Spa | $15,000-$35,000 | $350-$650 | 48-60 months |

These ranges assume standard lease to own terms without promotional offers. Your specific payment depends on the provider’s pricing structure, your approved terms, and any applicable discounts.

Initial Fees and Down Payments

While lease to own minimizes upfront costs compared to purchasing, you’ll typically face some initial expenses.

First Payment is due at signing or delivery, representing one month’s standard payment amount.

Application Fees charged by some providers range from nothing to approximately $50 depending on the company.

Delivery Charges if not included in your agreement typically run $200 to $500 based on distance and complexity.

Installation Costs vary dramatically based on requirements:

- Plug-and-play placement only: $100-$200

- Standard electrical installation: $500-$900

- Complex electrical work (distance from panel, upgrades needed): $1,000-$2,500

Budget for the full range of initial costs beyond just your first payment. The total to get your hot tub operational might run $500 to $3,000 beyond your first month’s lease payment.

Total Cost Over Lease Term Examples

Concrete examples illustrate what you’ll actually pay over the life of a lease agreement.

Example 1: Entry-Level Portable

- Cash price: $2,200

- Monthly payment: $95

- Term: 24 months

- Total payments: $2,280

- Premium over cash: $80 (3.6%)

Example 2: Mid-Range Acrylic

- Cash price: $5,500

- Monthly payment: $175

- Term: 36 months

- Total payments: $6,300

- Premium over cash: $800 (14.5%)

Example 3: Premium Model

- Cash price: $9,000

- Monthly payment: $275

- Term: 48 months

- Total payments: $13,200

- Premium over cash: $4,200 (46.7%)

These examples demonstrate how premiums can vary significantly based on terms and provider pricing. Longer terms generally result in higher percentage premiums.

Additional Ongoing Costs

Beyond lease payments, budget for these regular expenses:

Electricity and Utility Expenses

Hot tubs require continuous electrical power for heating, pumps, and control systems. Your electricity costs depend on local rates, hot tub efficiency, usage patterns, and climate.

Average Monthly Electricity Cost: $20-$50 for efficient models in moderate climates, potentially higher in cold regions or for less efficient units.

Energy-efficient features like quality insulation, tight-fitting covers, and efficient pumps reduce ongoing costs. These features often justify their higher purchase price through operational savings.

Water and Chemical Maintenance

Maintaining proper water chemistry requires regular chemical purchases.

Monthly Chemical Costs: $20-$40 for typical usage including sanitizer (chlorine or bromine), pH balancers, and occasional specialty treatments.

Water Replacement: Most hot tubs require complete draining and refilling every three to four months. Water costs are minimal, but the effort and chemical startup add to your maintenance requirements.

Insurance Requirements

Some lease agreements require insurance coverage protecting the hot tub against damage.

Additional Insurance Cost: $10-$30 monthly if required and not covered by existing homeowner’s policy.

Check with your homeowner’s insurance about coverage for the hot tub during your lease term. Some policies automatically extend to cover personal property on your premises, while others require endorsements.

Lease to Own vs. Other Hot Tub Financing Options

Comparing lease to own against alternative financing methods helps you determine the best approach for your circumstances. Each option carries different requirements, costs, and implications.

Lease to Own vs. Traditional Financing

Traditional financing through dealer programs, banks, or credit unions typically offers lower total cost but higher qualification requirements.

Credit Requirements: Traditional financing usually requires scores of 680 or higher. Lease to own accepts 500+.

Interest Rates: Traditional financing rates run 6-18% APR typically. Lease to own markup often equivalent to 20-50% or higher when calculated as APR.

Total Cost: Traditional financing costs less overall for those who qualify.

Approval Speed: Both can approve quickly, though traditional financing may require more documentation.

If your credit qualifies you for traditional financing at reasonable rates, that option typically saves money. Lease to own serves buyers who don’t qualify for traditional credit.

Lease to Own vs. Personal Loans

Personal loans from banks or credit unions represent another alternative for financing hot tub purchases.

Flexibility: Personal loans can be used at any retailer or for any model. Some lease to own programs restrict options.

Rates: Personal loans often carry lower effective rates than lease to own programs.

Credit Requirements: Personal loans typically require fair to good credit (640+), though some lenders work with lower scores.

Approval Process: Personal loans may take longer to fund than same-day lease to own approvals.

Lease to Own vs. Credit Card Purchases

Charging a hot tub to a credit card offers immediacy but carries significant risks.

Interest Rates: Credit card rates typically run 15-30% APR, potentially comparable to or higher than lease to own markups.

Credit Limit: Few consumers have sufficient available credit for large hot tub purchases.

Promotional Offers: 0% APR promotional periods can make credit cards attractive if you can pay off before the promotion ends.

Credit Utilization: Large purchases on revolving credit impact your credit utilization ratio, potentially lowering scores.

Credit cards work best when you can pay off quickly, particularly during promotional periods. Otherwise, lease to own may offer comparable or better terms.

Lease to Own vs. Renting

Hot tub rental represents an alternative for those uncertain about long-term commitment.

Cost Comparison: Rental rates run $200-$500 monthly for basic portable units, often more for premium models. Lease to own at $100-$200 monthly costs less while building toward ownership.

Commitment: Rentals typically operate month-to-month with easy cancellation. Lease to own locks you into longer commitments.

Ownership: Rentals never build equity. Lease to own payments eventually transfer ownership.

Flexibility: Rentals allow trying different models or returning between uses. Lease to own commits you to one specific unit.

Short-term rentals make sense for seasonal use, events, or trial periods. For ongoing use, lease to own provides better value by building toward ownership.

Common Mistakes to Avoid When Leasing to Own a Hot Tub

Learning from others’ mistakes helps you navigate the lease to own process more successfully. These common errors lead to regret, unexpected costs, or financial difficulties.

Not Reading the Fine Print

Signing any financial agreement without thorough review invites problems. Lease to own contracts contain provisions that significantly affect your obligations and costs.

Take time to read and understand every section of your agreement. Ask questions about anything unclear before signing. Pay particular attention to fee schedules, default provisions, and early termination terms.

If language confuses you, ask for plain-English explanations. Legitimate providers should willingly clarify terms. Reluctance to explain contract provisions signals potential problems.

Overestimating Your Budget

Excitement about getting a hot tub can cloud judgment about what you can realistically afford. Payment difficulties later create stress, fees, and potential credit damage.

Budget conservatively, accounting for the lease payment plus electricity, chemicals, maintenance, and incidentals. Leave room for unexpected expenses in other areas of your life.

Remember that payments continue monthly for the entire term regardless of how frequently you use the hot tub. Don’t assume future income increases will make payments easier.

Ignoring Total Cost Calculations

Focusing only on monthly payment amounts obscures the true cost of lease to own financing. Always calculate total payments over the full term.

Multiply monthly payment by number of months. Add delivery, installation, and any fees. Compare this total to cash purchase price to understand the premium you’re paying.

This comparison helps you evaluate whether the accessibility of lease to own justifies its cost in your specific situation.

Choosing the Wrong Size or Model

Selection mistakes lead to regret throughout your lease term. A too-small hot tub limits enjoyment, while an oversized one wastes money and space.

Think carefully about realistic usage patterns. Who will actually use the hot tub regularly? How often will you host larger groups? What features genuinely matter versus nice-to-have additions you might ignore?

If possible, try models before selecting. Sit in them, experience the jet configurations, and assess comfort. Twenty minutes in a wet test can prevent years of wishing you’d chosen differently.

Failing to Compare Multiple Providers

Accepting the first offer you receive might cost you significantly over the lease term. Different providers offer different terms for similar hot tubs.

Take time to check approval and terms with multiple lease to own companies. Compare monthly payments, total costs, early buyout options, and included services.

A lower monthly payment might result in higher total cost due to longer terms. Evaluate complete pictures rather than single factors.

Not Considering Ongoing Maintenance Costs

Your budget must accommodate more than just lease payments. Electricity, chemicals, water, filters, and occasional repairs add meaningful monthly costs.

Budget an additional $50-$100 monthly for typical ongoing expenses beyond your lease payment. This realistic accounting prevents financial stress once you’re committed.

Missing Payment Deadlines

Late payments trigger fees and potentially damage your credit. Setting up automatic payments prevents accidental misses.

Most lease companies offer autodraft from checking accounts or automatic credit card charges. Enrolling in these programs eliminates reliance on memory for monthly payments.

If automatic payment isn’t possible, set calendar reminders well before due dates. Treat lease payments with the same priority as rent or mortgage payments.

Not Understanding Early Termination Terms

Life circumstances change unexpectedly. Understanding your options for ending a lease early provides important knowledge even if you hope never to need it.

Review contract provisions for early termination including:

- Required notice periods

- Fees or penalties assessed

- Whether remaining payments are accelerated

- What happens to payments already made

- Hot tub return procedures

This knowledge helps you plan if job loss, relocation, illness, or other changes affect your ability to continue the lease.

Alternatives to Lease to Own Hot Tub Programs

Lease to own isn’t the only path to hot tub enjoyment. Depending on your circumstances and priorities, other approaches might serve you better.

Saving and Purchasing Outright

The most cost-effective approach is simply saving until you can buy without financing. While this requires patience, you’ll pay the lowest total amount and own your hot tub immediately.

Calculate how long you’d need to save. If setting aside $200 monthly toward a $5,000 hot tub, you’d have funds in roughly twenty-five months. Compare this timeline to a similar lease term and consider whether the wait is worthwhile.

The discipline of saving also confirms your commitment. If you struggle to save consistently for a hot tub, monthly lease payments might prove similarly difficult.

Buying Used or Refurbished Hot Tubs

Quality used hot tubs offer substantial savings over new purchases, often reducing prices by forty to sixty percent.

Finding Used Hot Tubs through Facebook Marketplace, Craigslist, or hot tub dealer trade-in inventory. Many sellers offer reasonable prices for well-maintained units they’re replacing or no longer using.

Inspection Considerations include checking shell condition, pump operation, heater function, control system responsiveness, and cover quality. Major component failures can cost thousands to repair, so thorough evaluation matters.

Warranty Limitations represent the primary drawback. Used hot tubs rarely include manufacturer warranty protection, so budget for potential repairs.

Hot Tub Rental Programs

Short-term rentals let you enjoy hot tubs without purchase or long-term commitment.

Portable Rental Companies deliver inflatable or portable units to your home for weekly or monthly use. Costs typically run $200-$400 monthly including delivery and setup.

When Renting Makes Sense: Temporary situations, seasonal use only, uncertain commitment, or trial periods before purchasing.

Layaway Plans from Dealers

Some dealers offer layaway arrangements where you make payments over time and receive the hot tub once paid in full.

How Layaway Works: You select your model and make regular payments without interest charges. Once fully paid, the dealer delivers your hot tub. No credit checks required.

Drawbacks: You don’t receive the hot tub until fully paid. Payments may not be protected if the dealer goes out of business. Not widely available.

Manufacturer Rebates and Seasonal Sales

Timing your purchase strategically can significantly reduce costs.

Best Times to Buy: End of season clearances (fall), holiday weekend sales, floor model closeouts, and year-end inventory reduction.

Negotiation Opportunities: Many dealers have pricing flexibility, particularly on outgoing models or during slow seasons. Asking about best available pricing or cash discounts can yield savings.

Package Deals: Bundles including covers, steps, chemicals, and installation often provide better value than purchasing components separately.

Frequently Asked Questions About Lease to Own Hot Tubs

What credit score do I need for lease to own hot tub approval?

Most lease to own programs approve applicants with credit scores of 500 or higher. Many programs specifically serve customers with poor, limited, or no credit history.

Approval typically depends more on current income stability and banking history than credit scores alone. Steady employment, regular direct deposits to a checking account, and residence stability often matter more than past credit challenges.

How much does it cost per month to lease to own a hot tub?

Monthly payments typically range from $50 to $300 depending on the hot tub model and lease term. Entry-level portable units cost around $50-$100 monthly, mid-range acrylic models run $125-$200 monthly, and premium spas reach $200-$350 monthly.

Your specific payment depends on retail price, lease term length, and provider pricing structure. Longer terms reduce monthly payments but increase total cost.

Can I return a hot tub if I can’t make the payments?

Most lease agreements allow you to return the hot tub, but you typically won’t receive refunds for payments already made. Early termination often involves fees and may include negative credit reporting.

Review your specific contract’s return and default provisions carefully before signing. Understanding these terms protects you if circumstances change unexpectedly.

Do lease to own hot tub payments build my credit?

Some lease to own companies report payment history to credit bureaus, which can help build credit through consistent on-time payments. However, not all providers report, so verify this feature if credit building matters to you.

Negative payment history and defaults are more consistently reported, meaning missed payments can damage your credit even if positive payments aren’t reported.

What happens at the end of my lease to own agreement?

When you complete all scheduled payments, ownership transfers fully to you. You’ll receive documentation confirming the lease is satisfied and your ownership rights.

Any remaining manufacturer warranty transfers to you as owner. The hot tub is yours to keep, sell, modify, or enjoy with no further obligations to the leasing company.

Are delivery and installation included in lease to own programs?

Inclusion varies by provider and dealer arrangement. Some programs bundle delivery and basic setup into the lease cost, while others charge these as separate fees.

Professional electrical installation for hardwired units almost always costs extra, typically $500-$1,500 depending on complexity. Clarify exactly what’s included before signing to avoid unexpected expenses

Can I pay off my lease to own hot tub early?

Yes, most programs include early buyout options allowing you to pay the remaining balance and take ownership before completing all scheduled payments. Many offer discounts for early payoff, particularly within the first ninety to one hundred days.

Early buyout often makes financial sense if you can access funds through bonuses, tax refunds, or other windfalls. Calculate the savings compared to completing the full term to evaluate your best approach.